Page 125 - Special Topic Session (STS) - Volume 1

P. 125

STS419 Liza M. et al.

is expected for IFIs to only have to do one-time analysis of daily balance,

calculate the validating signal, and let the algorithm learn from that data which

customer attributes have significant relationship with the signal. This learned

relationship would be the building block of the predictive model.

Name ADB MEB Income Race Gender Minimum Other

Education info…

000001 700 200 2000 Malay Male Not …

disclosed

000202 200 200 1200 Indian Not Degree …

disclosed

000310 110 200 2300 Chinese Male Degree …

Table 2. Customer attributes

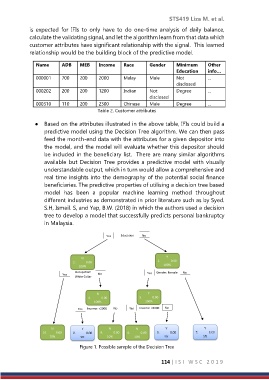

● Based on the attributes illustrated in the above table, IFIs could build a

predictive model using the Decision Tree algorithm. We can then pass

feed the month-end data with the attributes for a given depositor into

the model, and the model will evaluate whether this depositor should

be included in the beneficiary list. There are many similar algorithms

available but Decision Tree provides a predictive model with visually

understandable output, which in turn would allow a comprehensive and

real time insights into the demography of the potential social finance

beneficiaries. The predictive properties of utilising a decision tree based

model has been a popular machine learning method throughout

different industries as demonstrated in prior literature such as by Syed.

S.H, Ismail. S, and Yap, B.W. (2018) in which the authors used a decision

tree to develop a model that successfully predicts personal bankruptcy

in Malaysia.

Yes Education No

N Y

2. 0.00 1. 0.00

100% 100%

Occupation: Yes Gender: Female No

Yes No

White Collar

N Y

4. 0.00 3. 0.00

100% 100%

Yes Income: <2000 No Yes Income: <2000 No

N N N

10. 0.00 9. 0.00 6. 0.00

70% 10% 10%

Figure 1. Possible sample of the Decision Tree

114 | I S I W S C 2 0 1 9