Page 134 - Special Topic Session (STS) - Volume 4

P. 134

STS571 Jaanus Kroon

All payments with similar identifiers are aggregated in the data model. No

granular payment data are currently reported to keep the reporting volumes

low. The biggest limitation of using the card data for travel statistics is that the

residency of the card issuer is not always a good proxy for the residency of the

card holder, i.e. the traveller. Despite this, card payment statistics are a good

data source for quantifying inbound and outbound travel and credit card

payment data to calibrate expenditure figures. The dynamics of card

transaction volumes and turnover correlate strongly with the dynamics of

visits. Card expenditures at home and abroad correlate strongly with BoP

travel exports and imports. Card payment statistics could be developed further

by exploiting other information stored by the card service provider for each

card payment, such as Merchant Category Code (MCC), assigned by the

acquiring bank when the business applies for a merchant account, and

Transaction Category Codes (TCC) groups according to ISO 18245. Such data

are readily available and could give additional information needed for the

estimation of BoP sub-categories and provide important detail for economic

flash forecasts and other users of statistics.

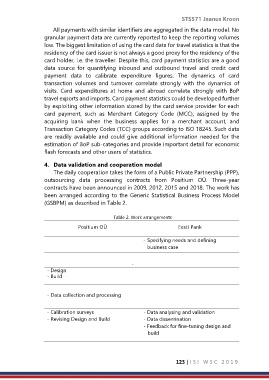

4. Data validation and cooperation model

The daily cooperation takes the form of a Public Private Partnership (PPP),

outsourcing data processing contracts from Positium OÜ. Three-year

contracts have been announced in 2009, 2012, 2015 and 2018. The work has

been arranged according to the Generic Statistical Business Process Model

(GSBPM) as described in Table 2.

Table 2. Work arrangements

Positium OÜ Eesti Pank

- Specifying needs and defining

business case

-

- Design

- Build

- Data collection and processing

- Calibration surveys - Data analysing and validation

- Revising Design and Build - Data dissemination

- Feedback for fine-tuning design and

build

123 | I S I W S C 2 0 1 9