Page 223 - Contributed Paper Session (CPS) - Volume 8

P. 223

CPS2256 Norzarita Samsudin

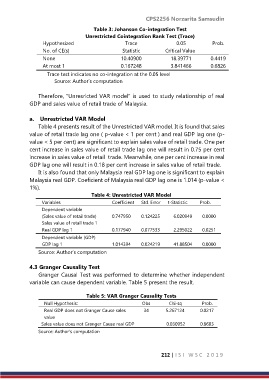

Table 3: Johanson Co-integration Test

Unrestricted Cointegration Rank Test (Trace)

Hypothesized Trace 0.05 Prob.

No. of CE(s) Statistic Critical Value

None 10.40900 18.39771 0.4419

At most 1 0.167248 3.841466 0.6826

Trace test indicates no co-integration at the 0.05 level

Source: Author’s computation

Therefore, “Unresricted VAR model” is used to study relationship of real

GDP and sales value of retail trade of Malaysia.

a. Unrestricted VAR Model

Table 4 presents result of the Unrestricted VAR model. It is found that sales

value of retail trade lag one ( p-value < 1 per cent ) and real GDP lag one (p-

value < 5 per cent) are significant to explain sales value of retail trade. One per

cent increase in sales value of retail trade lag one will result in 0.75 per cent

increase in sales value of retail trade. Meanwhile, one per cent increase in real

GDP lag one will result in 0.18 per cent increase in sales value of retail trade.

It is also found that only Malaysia real GDP lag one is significant to explain

Malaysia real GDP. Coeficient of Malaysia real GDP lag one is 1.014 (p-value <

1%).

Table 4: Unrestricted VAR Model

Variables Coefficient Std. Error t-Statistic Prob.

Dependent variable

(Sales value of retail trade) 0.747950 0.124225 6.020949 0.0000

Sales value of retail trade 1

Real GDP lag 1 0.177940 0.077533 2.295022 0.0251

Dependent variable (GDP)

GDP lag 1 1.014394 0.024219 41.88504 0.0000

Source: Author’s computation

4.3 Granger Causality Test

Granger Causal Test was performed to determine whether independent

variable can cause dependent variable. Table 5 present the result.

Table 5: VAR Granger Causality Tests

Null Hypothesis: Obs Chi-sq Prob.

Real GDP does not Granger Cause sales 34 5.267124 0.0217

value

Sales value does not Granger Cause real GDP 0.030952 0.8603

Source: Author’s computation

212 | I S I W S C 2 0 1 9