Page 128 - Invited Paper Session (IPS) - Volume 1

P. 128

IPS102 Peter V. et al.

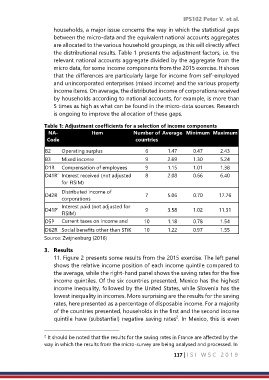

households, a major issue concerns the way in which the statistical gaps

between the micro-data and the equivalent national accounts aggregates

are allocated to the various household groupings, as this will directly affect

the distributional results. Table 1 presents the adjustment factors, i.e. the

relevant national accounts aggregate divided by the aggregate from the

micro data, for some income components from the 2015 exercise. It shows

that the differences are particularly large for income from self-employed

and unincorporated enterprises (mixed income) and the various property

income items. On average, the distributed income of corporations received

by households according to national accounts, for example, is more than

5 times as high as what can be found in the micro-data sources. Research

is ongoing to improve the allocation of these gaps.

Table 1: Adjustment coefficients for a selection of income components

NA- Item Number of Average Minimum Maximum

Code countries

B2 Operating surplus 6 1.47 0.47 2.43

B3 Mixed income 9 2.69 1.30 5.24

D1R Compensation of employees 9 1.15 1.01 1.38

D41R’ Interest received (not adjusted 8 2.08 0.66 6.40

for FISIM)

Distributed income of

D42R 7 5.06 0.70 17.76

corporations

Interest paid (not adjusted for

D41P’ 9 3.58 1.02 11.31

FISIM)

D5P Current taxes on income and 10 1.18 0.78 1.54

wealth

D62R Social benefits other than STiK 10 1.22 0.97 1.55

Source: Zwijnenburg (2016)

3. Results

11. Figure 2 presents some results from the 2015 exercise. The left panel

shows the relative income position of each income quintile compared to

the average, while the right-hand panel shows the saving rates for the five

income quintiles. Of the six countries presented, Mexico has the highest

income inequality, followed by the United States, while Slovenia has the

lowest inequality in incomes. More surprising are the results for the saving

rates, here presented as a percentage of disposable income. For a majority

of the countries presented, households in the first and the second income

2

quintile have (substantial) negative saving rates . In Mexico, this is even

2 It should be noted that the results for the saving rates in France are affected by the

way in which the results from the micro-survey are being analysed and processed. In

117 | I S I W S C 2 0 1 9