Page 75 - Invited Paper Session (IPS) - Volume 2

P. 75

IPS184 Sanvi Avouyi-Dovi et al.

- Currency plus overnight deposits, labelled “M1”;

- Short-term savings accounts and deposits with an agreed maturity up

to 2 years, labelled “M2M1”;

- Money market fund shares, labelled “M3M2”;

- Home savings plans (Plans d’épargne logement, PEL), labelled “PEL”;

- Equities and non-money market fund shares, labelled “Assets “;

- The sum of life insurance contracts, long-term savings plans in

securities distributed by banks (Plan d’Épargne Populaire, PEP), and

debt securities held directly by households, labelled “Lifebonds”.

For M1, we use the apparent interest rate on deposits that is available in

the financial accounts for the period 2003-2016. We compute a weighted-

average return for M2M1 based on interest rates for the different short-term

deposits included in it. For M3M2, we use the overnight rate. For PEL, we use

the interest rate set by government. For Assets, we compute the annualised

return on the CAC40 stock market index. As we do not have access to returns

on life-insurance contracts on a quarterly basis for the entire sample, the

return on Lifebonds is the 10-year yield on Treasuries. Finally, to obtain the

real returns, all the previous nominal returns are deflated by the inflation rate

drawn from the CPI. Some additional explanatory factors are also tested in the

relationships describing the dynamics of the shares

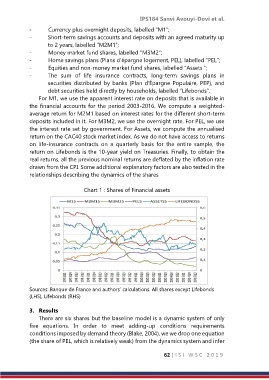

Chart 1 : Shares of Financial assets

Sources: Banque de France and authors’ calculations. All shares except Lifebonds

(LHS), Lifebonds (RHS)

3. Results

There are six shares but the baseline model is a dynamic system of only

five equations. In order to meet adding-up conditions requirements

conditions imposed by demand theory (Blake, 2004), we we drop one equation

(the share of PEL, which is relatively weak) from the dynamics system and infer

62 | I S I W S C 2 0 1 9