Page 323 - Special Topic Session (STS) - Volume 1

P. 323

STS441 Andrea N.

underreporting behavior and of the nonresponse bias. Yet, even if register

data are available only at the aggregate level, that would provide beneficial

information. Where register data can be disaggregated by some household

groups with classifications available in the HFCS data, assessments on the

degree of reporting bias across various household groups can be made. Yet,

administrative sources are not perfect either. The main limitation is that they

have not been designed thinking of a statistical use. Moreover, admin data

may suffer of undercoverage problems (i.e. personal tax data may not include

individual below a given threshold) or may be available with some delay (i.e.

personal data are generally available with a 2-years lag from reference period).

Finally, admin data are likely to use different concepts and definitions from the

ones used in the survey.

Administrative records are likely to be the key to produce reliable

distributional indicators. Yet, more research is still needed to use them in

combination with survey data. This is probably one of the main challenges for

the near future.

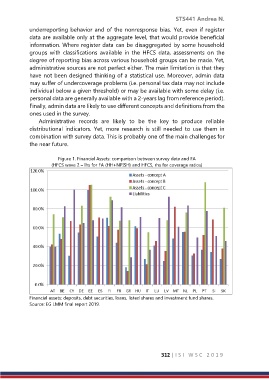

Figure 1. Financial Assets: comparison between survey data and FA

(HFCS wave 2 – lhs for FA (HH+NPISH) and HFCS, rhs for coverage ratios)

Financial assets: deposits, debt securities, loans, listed shares and investment fund shares.

Source: EG LMM final report 2019.

312 | I S I W S C 2 0 1 9