Page 324 - Special Topic Session (STS) - Volume 1

P. 324

STS441 Andrea N.

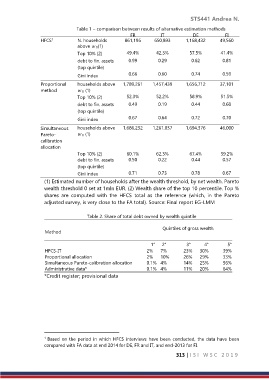

Table 1 – comparison between results of alternative estimation methods

FR IT DE FI

1

HFCS N. households 861,196 650,893 1,168,432 49,560

above w 0(1)

Top 10% (2) 49.4% 42.3% 57.5% 41.4%

debt to fin. assets 0.99 0.29 0.62 0.81

(top quintile)

Gini index 0.66 0.60 0.74 0.59

Proportional households above 1,789,261 1,457,439 1,656,712 37,101

method w 0 (1)

Top 10% (2) 52.3% 52.2% 58.9% 51.5%

debt to fin. assets 0.49 0.19 0.44 0.60

(top quintile)

Gini index 0.67 0.64 0.72 0.70

Simultaneous households above 1,686,232 1,261,837 1,694,376 46,000

Pareto- w 0 (1)

calibration

allocation

Top 10% (2) 60.1% 62.3% 67.4% 39.2%

debt to fin. assets 0.50 0.22 0.44 0.57

(top quintile)

Gini index 0.71 0.73 0.78 0.67

(1) Estimated number of households after the wealth threshold, by net wealth. Pareto

wealth threshold 0 set at 1mln EUR. (2) Wealth share of the top 10 percentile. Top %

shares are computed with the HFCS total as the reference (which, in the Pareto

adjusted survey, is very close to the FA total). Source: Final report EG-LMM

Table 2. Share of total debt owned by wealth quintile

Quintiles of gross wealth

Method

1° 2° 3° 4° 5°

HFCS-IT 2% 7% 23% 30% 39%

Proportional allocation 2% 10% 26% 29% 33%

Simultaneous Pareto-calibration allocation 0.1% 4% 14% 25% 56%

Administrative data* 0.1% 4% 11% 20% 64%

*Credit register; provisional data

1 Based on the period in which HFCS interviews have been conducted, the data have been

compared with FA data at end 2014 for DE, FR and IT, and end-2013 for FI.

313 | I S I W S C 2 0 1 9