Page 153 - Contributed Paper Session (CPS) - Volume 8

P. 153

CPS2223 Siti Nuraini R. et al.

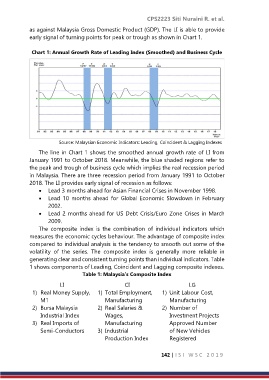

as against Malaysia Gross Domestic Product (GDP). The LI is able to provide

early signal of turning points for peak or trough as shown in Chart 1.

Chart 1: Annual Growth Rate of Leading Index (Smoothed) and Business Cycle

Source: Malaysian Economic Indicators: Leading, Coincident & Lagging Indexes

The line in Chart 1 shows the smoothed annual growth rate of LI from

January 1991 to October 2018. Meanwhile, the blue shaded regions refer to

the peak and trough of business cycle which implies the real recession period

in Malaysia. There are three recession period from January 1991 to October

2018. The LI provides early signal of recession as follows:

Lead 3 months ahead for Asian Financial Crises in November 1998.

Lead 10 months ahead for Global Economic Slowdown in February

2002.

Lead 2 months ahead for US Debt Crisis/Euro Zone Crises in March

2009.

The composite index is the combination of individual indicators which

measures the economic cycles behaviour. The advantage of composite index

compared to individual analysis is the tendency to smooth out some of the

volatility of the series. The composite index is generally more reliable in

generating clear and consistent turning points than individual indicators. Table

1 shows components of Leading, Coincident and Lagging composite indexes.

Table 1: Malaysia’s Composite Index

LI CI LG

1) Real Money Supply, 1) Total Employment, 1) Unit Labour Cost,

M1 Manufacturing Manufacturing

2) Bursa Malaysia 2) Real Salaries & 2) Number of

Industrial Index Wages, Investment Projects

3) Real Imports of Manufacturing Approved Number

Semi-Conductors 3) Industrial of New Vehicles

Production Index Registered

142 | I S I W S C 2 0 1 9