Page 156 - Contributed Paper Session (CPS) - Volume 8

P. 156

CPS2223 Siti Nuraini R. et al.

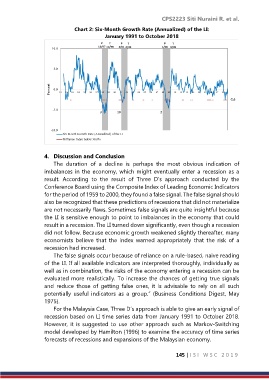

Chart 2: Six-Month Growth Rate (Annualized) of the LI:

January 1991 to October 2018

4. Discussion and Conclusion

The duration of a decline is perhaps the most obvious indication of

imbalances in the economy, which might eventually enter a recession as a

result. According to the result of Three D’s approach conducted by the

Conference Board using the Composite Index of Leading Economic Indicators

for the period of 1959 to 2000, they found a false signal. The false signal should

also be recognized that these predictions of recessions that did not materialize

are not necessarily flaws. Sometimes false signals are quite insightful because

the LI is sensitive enough to point to imbalances in the economy that could

result in a recession. The LI turned down significantly, even though a recession

did not follow. Because economic growth weakened slightly thereafter, many

economists believe that the index warned appropriately that the risk of a

recession had increased.

The false signals occur because of reliance on a rule-based, naive reading

of the LI. If all available indicators are interpreted thoroughly, individually as

well as in combination, the risks of the economy entering a recession can be

evaluated more realistically. To increase the chances of getting true signals

and reduce those of getting false ones, it is advisable to rely on all such

potentially useful indicators as a group.” (Business Conditions Digest, May

1975).

For the Malaysia Case, Three D’s approach is able to give an early signal of

recession based on LI time series data from January 1991 to October 2018.

However, it is suggested to use other approach such as Markov-Switching

model developed by Hamilton (1996) to examine the accuracy of time series

forecasts of recessions and expansions of the Malaysian economy.

145 | I S I W S C 2 0 1 9