Page 245 - Contributed Paper Session (CPS) - Volume 6

P. 245

CPS1908 Klára A. T. et al.

- N3 category covers both agricultural own account production and costs of

own account construction.

- N4 includes legal persons included in Register but not included in statistics.

- N5 covers agricultural production of small enterprises and sole proprietors

included in register but not in statistics.

- Economic performance due to deliberate misreporting and VAT fraud

without complicity belongs to N6 category.

- Sole proprietors not subject to VAT but submit Tax return, wages and salaries

in kind, gratuity, tips and reimbursed costs included in N7 category.

The estimations for these items should be harmonized by the three

mentioned approaches: production, income generation and employment

method.

The balancing item in National Accounts process table reconciles the

production, the expenditure and the income generation sides, while in the

employment PT it reconciles the two approaches of compilation of

employment in domestic concept: the PT approach and that derived from the

national concept as Table 1. shows.

We have examined each exhaustiveness adjustment category whether

covering additional nonobserved employment or not. It is illustrated in Table

2.

The investigation of these non-observed economic categories should be

based on different data sources and from different concepts in order to

facilitate the cross validation. For example, the N6 category of exhaustiveness

adjustment from production side can be based on tax audit data, or theoretical

VAT estimation (Eurostat (2005a)), while the N6 labour input should based on

labour inspection data.

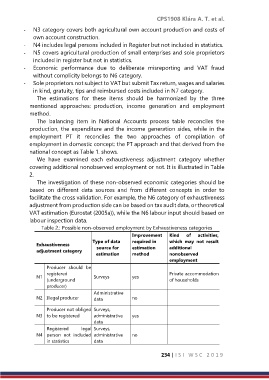

Table 2.: Possible non-observed employment by Exhaustiveness categories

Improvement Kind of activities,

Type of data required in which may not result

Exhaustiveness source for estimation additional

adjustment category

estimation method nonobserved

employment

Producer should be

registered Private accommodation

N1 Surveys yes

(underground of households

producer)

Administrative

N2 Illegal producer data no

Producer not obliged Surveys,

N3 to be registered administrative yes

data

Registered legal Surveys,

N4 person not included administrative no

in statistics data

234 | I S I W S C 2 0 1 9