Page 272 - Special Topic Session (STS) - Volume 3

P. 272

STS543 Muizz A. et al.

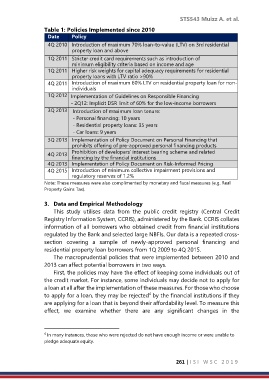

Table 1: Policies Implemented since 2010

Date Policy

4Q 2010 Introduction of maximum 70% loan-to-value (LTV) on 3rd residential

property loan and above

1Q 2011 Stricter credit card requirements such as introduction of

minimum eligibility criteria based on income and age

1Q 2011 Higher risk weights for capital adequacy requirements for residential

property loans with LTV ratio >90%

4Q 2011 Introduction of maximum 60% LTV on residential property loan for non-

individuals

1Q 2012 Implementation of Guidelines on Responsible Financing

- 2Q12: Implicit DSR limit of 60% for the low-income borrowers

3Q 2013 Introduction of maximum loan tenure:

- Personal financing: 10 years

- Residential property loans: 35 years

- Car loans: 9 years

3Q 2013 Implementation of Policy Document on Personal Financing that

prohibits offering of pre-approved personal financing products

4Q 2013 Prohibition of developers’ interest bearing scheme and related

financing by the financial institutions

4Q 2013 Implementation of Policy Document on Risk-Informed Pricing

4Q 2015 Introduction of minimum collective impairment provisions and

regulatory reserves of 1.2%

Note: These measures were also complimented by monetary and fiscal measures (e.g. Real

Property Gains Tax).

3. Data and Empirical Methodology

This study utilises data from the public credit registry (Central Credit

Registry Information System, CCRIS), administered by the Bank. CCRIS collates

information of all borrowers who obtained credit from financial institutions

regulated by the Bank and selected large NBFIs. Our data is a repeated cross-

section covering a sample of newly-approved personal financing and

residential property loan borrowers from 1Q 2009 to 4Q 2015.

The macroprudential policies that were implemented between 2010 and

2013 can affect potential borrowers in two ways.

First, the policies may have the effect of keeping some individuals out of

the credit market. For instance, some individuals may decide not to apply for

a loan at all after the implementation of these measures. For those who choose

to apply for a loan, they may be rejected by the financial institutions if they

4

are applying for a loan that is beyond their affordability level. To measure this

effect, we examine whether there are any significant changes in the

4 In many instances, those who were rejected do not have enough income or were unable to

pledge adequate equity.

261 | I S I W S C 2 0 1 9