Page 104 - Contributed Paper Session (CPS) - Volume 5

P. 104

CPS1111 Jitendra Kumar et al.

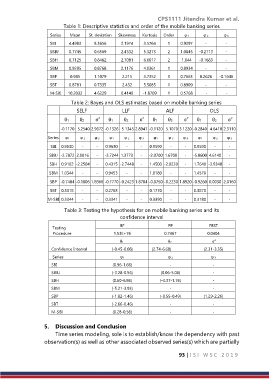

Table 1: Descriptive statistics and order of the mobile banking series

Series Mean St. deviation Skewness Kurtosis Order ϕ1 ϕ 2 ϕ 3

SBI 4.4983 8.3656 2.1974 3.5764 1 0.9297 - -

SBBJ 0.7745 0.6569 2.4332 5.3273 2 1.0845 -0.2113 -

SBH 0.7125 0.8462 2.7081 6.6017 2 1.044 -0.1683 -

SBM 0.9295 0.8768 2.1176 4.0361 1 0.8934 - -

SBP 0.985 1.1079 2.215 3.7352 3 0.7663 0.2626 -0.1646

SBT 0.8781 0.7335 2.432 5.5085 1 0.8909 - -

M-SBI 10.2032 4.6229 0.4149 -1.8709 1 0.5768 - -

Table 2: Bayes and OLS estimates based on mobile banking series

SELF LLF ALF OLS

θ1 θ2 σ 2 θ1 θ2 σ 2 θ1 θ2 σ 2 θ1 θ2 σ 2

-0.1170 5.2540 2.9672 -0.1326 5.1345 2.8947 -0.1120 5.1070 3.1220 -0.2840 4.6410 2.3110

Series ϕ1 ϕ 2 ϕ 3 ϕ1 ϕ 2 ϕ 3 ϕ1 ϕ 2 ϕ 3 ϕ1 ϕ 2 ϕ 3

SBI 0.9630 - - 0.9630 - - 0.9590 - - 0.9590 - -

SBBJ -2.7872 2.0816 - -3.7244 1.3773 - -2.0700 1.6700 - -5.0600 4.6140 -

SBH 0.9102 -2.2504 - 0.4315 -2.7448 - 1.4500 -2.0230 - 1.7640 -3.9340 -

SBM 1.0344 - - 0.9453 - - 1.0180 - - 1.4570 - -

SBP -0.7404 -0.1806 1.8968 -0.7770 -0.2423 1.8704 -0.8750 -0.2230 1.8920 -0.9260 0.0030 2.0160

SBT 0.3318 - - 0.2763 - - 0.1770 - - 0.3870 - -

M-SBI 0.3344 - - 0.3341 - - 0.3390 - - 0.3180 - -

Table 3: Testing the hypothesis for on mobile banking series and its

confidence interval

Testing BF PP FBST

Procedure 1.53E+76 0.7467 0.0404

θ1 θ2 σ 2

Confidence Interval (-0.45-0.08) (2.74-6.68) (2.31-3.35)

Series ϕ1 ϕ 2 ϕ 3

SBI (0.96-1.66) - -

SBBJ (-3.28-0.56) (0.06-5.06) -

SBH (0.60-6.86) (-4.37-1.76) -

SBM (-5.21-3.93) - -

SBP (-1.82-1.46) (-0.55-0.49) (1.29-2.26)

SBT (-2.66-0.46) - -

M-SBI (0.28-0.56) - -

5. Discussion and Conclusion

Time series modeling, sole is to establish/know the dependency with past

observation(s) as well as other associated observed series(s) which are partially

93 | I S I W S C 2 0 1 9