Page 249 - Contributed Paper Session (CPS) - Volume 7

P. 249

CPS2075 Wan Siti Zaleha W. Z. et al.

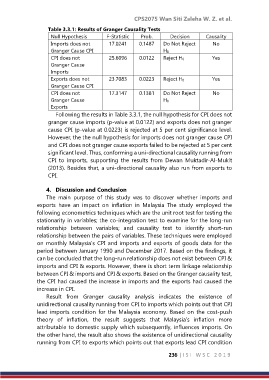

Table 3.3.1: Results of Granger Causality Tests

Null Hypothesis F-Statistic Prob. Decision Causality

Imports does not 17.0241 0.1487 Do Not Reject No

Granger Cause CPI H0

CPI does not 25.6096 0.0122 Reject H0 Yes

Granger Cause

Imports

Exports does not 23.7083 0.0223 Reject H0 Yes

Granger Cause CPI

CPI does not 17.3147 0.1381 Do Not Reject No

Granger Cause H0

Exports

Following the results in Table 3.3.1, the null hypothesis for CPI does not

granger cause imports (p‐value at 0.0122) and exports does not granger

cause CPI (p‐value at 0.0223) is rejected at 5 per cent significance level.

However, the the null hypothesis for imports does not granger cause CPI

and CPI does not granger cause exports failed to be rejected at 5 per cent

significant level. Thus, conforming a uni‐directional causality running from

CPI to imports, supporting the results from Dewan Muktadir‐Al‐Mukit

(2013). Besides that, a uni‐directional causality also run from exports to

CPI.

4. Discussion and Conclusion

The main purpose of this study was to discover whether imports and

exports have an impact on inflation in Malaysia The study employed the

following econometrics techniques which are the unit root test for testing the

stationarity in variables; the co-integration test to examine for the long-run

relationship between variables; and causality test to identify short-run

relationship between the pairs of variables. These techniques were employed

on monthly Malaysia’s CPI and imports and exports of goods data for the

period between January 1990 and December 2017. Based on the findings, it

can be concluded that the long-run relationship does not exist between CPI &

imports and CPI & exports. However, there is short term linkage relationship

between CPI & imports and CPI & exports. Based on the Granger causality test,

the CPI had caused the increase in imports and the exports had caused the

increase in CPI.

Result from Granger causality analysis indicates the existence of

unidirectional causality running from CPI to imports which points out that CPI

lead imports condition for the Malaysia economy. Based on the cost-push

theory of inflation, the result suggests that Malaysia’s inflation more

attributable to domestic supply which subsequently, influences imports. On

the other hand, the result also shows the existence of unidirectional causality

running from CPI to exports which points out that exports lead CPI condition

236 | I S I W S C 2 0 1 9