Page 238 - Contributed Paper Session (CPS) - Volume 8

P. 238

CPS2265 Siti Salwani Ismail et al.

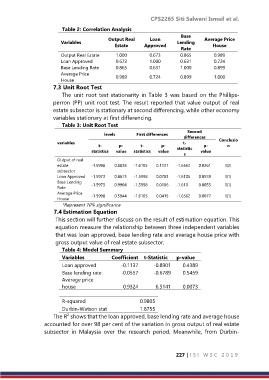

Table 2: Correlation Analysis

Base

Output Real Loan Average Price

Variables Lending

Estate Approved House

Rate

Output Real Estate 1.000 0.673 0.865 0.989

Loan Approved 0.673 1.000 0.631 0.724

Base Lending Rate 0.865 0.631 1.000 0.899

Average Price 0.989 0.724 0.899 1.000

House

7.3 Unit Root Test

The unit root test stationarity in Table 3 was based on the Phillips-

perron (PP) unit root test. The result reported that value output of real

estate subsector is stationary at second differencing, while other economy

variables stationary at first differencing.

Table 3: Unit Root Test

Second

levels First differences

differences

variables t- Conclusio

t- p- t- p- p- n

statistics value statistics value statistic value

s

Output of real

estate -1.5998 0.8838 -1.6105 0.1337 -1.6562 0.0261 I(2)

subsector

Loan Approved -1.5973 0.8613 -1.5998 0.0783 -1.6105 0.0559 I(1)

Base Lending

Rate -1.5973 0.9904 -1.5998 0.0106 -1.610 0.0053 I(1)

Average Price

House -1.5998 0.5944 -1.6105 0.0415 -1.6562 0.0077 I(1)

*Represent 10% significance

7.4 Estimation Equation

This section will further discuss on the result of estimation equation. This

equation measure the relationship between three independent variables

that was loan approved, base lending rate and average house price with

gross output value of real estate subsector.

Table 4: Model Summary

Variables Coefficient t-Statistic p-value

Loan approved -0.1137 -0.8901 0.4389

Base lending rate -0.0557 -0.6789 0.5459

Average price

house 0.9324 6.5141 0.0073

R-squared 0.9805

Durbin-Watson stat 1.8755

2

The R shows that the loan approved, base lending rate and average house

accounted for over 98 per cent of the variation in gross output of real estate

subsector in Malaysia over the research period. Meanwhile, from Durbin-

227 | I S I W S C 2 0 1 9