Page 239 - Contributed Paper Session (CPS) - Volume 8

P. 239

CPS2265 Siti Salwani Ismail et al.

Watson test shows that there are positive autocorrelation between gross

output value and its independent variables.

In the final part of the analysis, the function was developed as follows:

Gross output value of real estate subsector = -0. 1137 Loan approved- 0.0557

Base lending rate +0.9324 Average price house + ei

As these result showed, the coefficient for all independent variables was

significant at 10 per cent level with the expected sign. When loan approved

and based lending rate increased by one per cent, gross output will decrease

by 0.11 per cent and 0.06 per cent respectively. While average price house

increase by one per cent, gross output for real estate industry will increase

0.93 per cent.

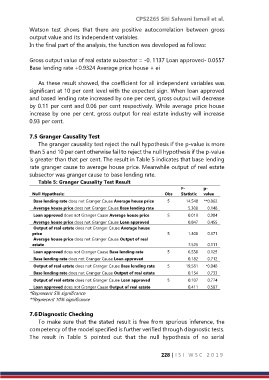

7.5 Granger Causality Test

The granger causality test reject the null hypothesis if the p-value is more

than 5 and 10 per cent otherwise fail to reject the null hypothesis if the p-value

is greater than that per cent. The result in Table 5 indicates that base lending

rate granger cause to average house price. Meanwhile output of real estate

subsector was granger cause to base lending rate.

Table 5: Granger Causality Test Result

F- p-

Null Hypothesis: Obs Statistic value

Base lending rate does not Granger Cause Average house price 5 14.548 **0.062

Average house price does not Granger Cause Base lending rate 5.308 0.148

Loan approved does not Granger Cause Average house price 5 0.019 0.904

Average house price does not Granger Cause Loan approved 0.847 0.455

Output of real estate does not Granger Cause Average house

price 5 1.308 0.371

Average house price does not Granger Cause Output of real

estate 7.525 0.111

Loan approved does not Granger Cause Base lending rate 5 6.530 0.125

Base lending rate does not Granger Cause Loan approved 0.182 0.712

Output of real estate does not Granger Cause Base lending rate 5 19.581 *0.048

Base lending rate does not Granger Cause Output of real estate 0.154 0.733

Output of real estate does not Granger Cause Loan approved 5 0.107 0.774

Loan approved does not Granger Cause Output of real estate 0.411 0.587

*Represent 5% significance

**Represent 10% significance

7.6 Diagnostic Checking

To make sure that the stated result is free from spurious inference, the

competency of the model specified is further verified through diagnostic tests.

The result in Table 5 pointed out that the null hypothesis of no serial

228 | I S I W S C 2 0 1 9