Page 363 - Contributed Paper Session (CPS) - Volume 6

P. 363

CPS1966 Jessa L. S. C. et al.

has a higher weight, which may also indicate a decline in health, Other

Traditional is more often bought. In terms of income, Unit-linked can also be

preferred by low earning individuals.

To assess the accuracy of the models in predicting, the final models were

used to predict the test data.

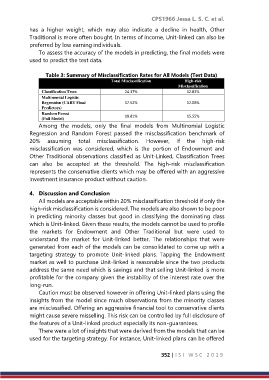

Table 3: Summary of Misclassification Rates for All Models (Test Data)

Total Misclassification High-risk

Misclassification

Classification Trees 24.37% 12.83%

Multinomial Logistic

Regression (CART Final 17.52% 12.08%

Predictors)

Random Forest 18.81% 15.55%

(Full Model)

Among the models, only the final models from Multinomial Logistic

Regression and Random Forest passed the misclassification benchmark of

20% assuming total misclassification. However, if the high-risk

misclassification was considered, which is the portion of Endowment and

Other Traditional observations classified as Unit-Linked, Classification Trees

can also be accepted at the threshold. The high-risk misclassification

represents the conservative clients which may be offered with an aggressive

investment insurance product without caution.

4. Discussion and Conclusion

All models are acceptable within 20% misclassification threshold if only the

high-risk misclassification is considered. The models are also shown to be poor

in predicting minority classes but good in classifying the dominating class

which is Unit-linked. Given these results, the models cannot be used to profile

the markets for Endowment and Other Traditional but were used to

understand the market for Unit-linked better. The relationships that were

generated from each of the models can be consolidated to come up with a

targeting strategy to promote Unit-linked plans. Tapping the Endowment

market as well to purchase Unit-linked is reasonable since the two products

address the same need which is savings and that selling Unit-linked is more

profitable for the company given the instability of the interest rate over the

long-run.

Caution must be observed however in offering Unit-linked plans using the

insights from the model since much observations from the minority classes

are misclassified. Offering an aggressive financial tool to conservative clients

might cause severe misselling. This risk can be controlled by full disclosure of

the features of a Unit-linked product especially its non-guarantees.

There were a lot of insights that were derived from the models that can be

used for the targeting strategy. For instance, Unit-linked plans can be offered

352 | I S I W S C 2 0 1 9