Page 122 - Invited Paper Session (IPS) - Volume 2

P. 122

IPS 188 G. P. Samanta

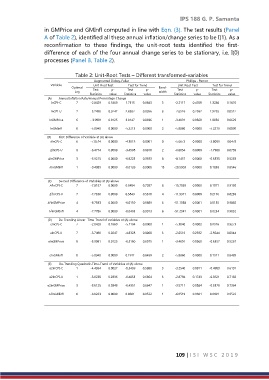

in GMPrice and GMInfl computed in line with Eqn. (3). The test results (Panel

A of Table 2), identified all these annual inflation/change series to be I(1). As a

reconfirmation to these findings, the unit-root tests identified the first-

difference of each of the four annual change series to be stationary, i.e. I(0)

processes (Panel B, Table 2).

Table 2: Unit-Root Tests – Different transformed-variables

Augmented Dickey-Fuller Phillips - Perron

Variable Unit-Root Test Test for Trend Unit-Root Test Test for Trend

Optimal Test p- Test p- Band- Test p- Test p-

Lag width

Statistics value Statistics value Statistics value Statistics value

(A) Annual Inflation Rate/Annual Percentage Change

InCPI-C 7 -2.8429 0.1869 1.7515 0.0843 3 -2.2117 0.4769 1.3288 0.1876

lnCPI-U 7 -3.7490 0.0247 2.8582 0.0056 3 -2.6516 0.2592 1.9785 0.0512

lnGMPrice 6 - 3.9981 0.0125 3.0147 0.0036 1 -3.4091 0.0569 1.8850 0.0629

lnGMInfl 0 -5.8940 0.0000 -5.2213 0.0000 2 -5.8860 0.0000 -5.2213 0.0000

(B) First-Difference of Variable at (A) above

∆lnCPI-C 6 -7.0514 0.0000 -4.3018 0.0001 0 -5.6672 0.0000 -2.0093 0.0478

∆lnCPI-U 6 -6.4774 0.0000 -3.4508 0.0010 2 -6.0054 0.0000 -1.7980 0.0759

∆lnGMPrice 3 -5.9215 0.0000 -0.9223 0.3593 8 -8.1457 0.0000 -0.6333 0.5283

∆lnGMInfl 1 -9.4089 0.0000 -0.0126 0.9900 13 -20.5903 0.0000 0.1838 0.8546

(C) Second-Difference of Variables at (A) above

2

∆ lnCPI-C 7 -7.8157 0.0000 0.3484 0.7287 8 -15.7029 0.0000 0.1071 0.9150

2

∆ lnCPI-U 7 -7.7350 0.0000 0.5843 0.5610 4 -11.9371 0.0000 0.2176 0.8283

∆ lnGMPrice 4 -8.7383 0.0000 -0.0139 0.9889 6 -51.1038 0.0001 0.0135 0.9892

2

∆ lnGMInfl 4 -7.7786 0.0000 -0.0493 0.9913 6 -51.2341 0.0001 0.0234 0.9852

2

(D) De-Trending Linear -Time-Trend of variables at (A) above

elnCPI-C 7 -2.8428 0.1869 -5.1194 0.0000 1 -5.3040 0.0002 0.0916 0.9273

elnCPI-U 7 -3.7490 0.0247 -4.8328 0.0000 3 -2.6516 0.2592 -2.9244 0.0044

elnGMPrice 6 -3.9981 0.0125 -0.5160 0.6075 1 -3.4091 0.0569 -0.6357 0.5267

elnGMInfl 0 -5.8940 0.0000 0.1911 0.8489 2 -5.8860 0.0000 0.1911 0.8489

(E) De-Trending Quadratic-Time-Trend of Variables at (A) above

e2lnCPI-C 1 -4.4954 0.0027 -0.5439 0.5880 3 -3.2540 0.0811 -0.4989 0.6191

e2lnCPI-U 1 -3.6238 0.0336 -0.4053 0.6864 3 -2.8794 0.1743 -0.3621 0.7182

e2lnGMPrice 3 -3.6125 0.0348 -0.4351 0.6647 1 -3.5711 0.0384 -0.3378 0.7364

e2lnGMInfl 0 -6.0223 0.0000 0.0601 0.9522 1 -6.0519 0.0601 0.0601 0.9522

109 | I S I W S C 2 0 1 9