Page 65 - Special Topic Session (STS) - Volume 2

P. 65

STS459 Gan C.P. et al.

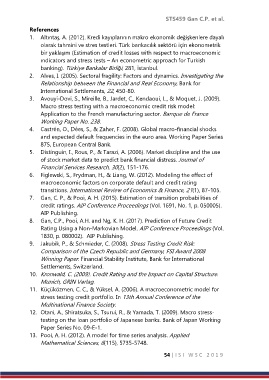

References

1. Altıntaş, A. (2012). Kredi kayıplarının makro ekonomik değişkenlere dayalı

olarak tahmini ve stres testleri. Türk bankacılık sektörü için ekonometrik

bir yaklaşım (Estimation of credit losses with respect to macroeconomic

ındicators and stress tests – An econometric approach for Turkish

banking). Türkiye Bankalar Birliği, 281, İstanbul.

2. Alves, I. (2005). Sectoral fragility: Factors and dynamics. Investigating the

Relationship between the Financial and Real Economy, Bank for

International Settlements, 22, 450-80.

3. Avouyi-Dovi, S., Mireille, B., Jardet, C., Kendaoui, L., & Moquet, J. (2009).

Macro stress testing with a macroeconomic credit risk model:

Application to the French manufacturing sector. Banque de France

Working Paper No. 238.

4. Castrén, O., Dées, S., & Zaher, F. (2008). Global macro-financial shocks

and expected default frequencies in the euro area. Working Paper Series

875, European Central Bank.

5. Distinguin, I., Rous, P., & Tarazi, A. (2006). Market discipline and the use

of stock market data to predict bank financial distress. Journal of

Financial Services Research, 30(2), 151-176.

6. Figlewski, S., Frydman, H., & Liang, W. (2012). Modeling the effect of

macroeconomic factors on corporate default and credit rating

transitions. International Review of Economics & Finance, 21(1), 87-105.

7. Gan, C. P., & Pooi, A. H. (2015). Estimation of transition probabilities of

credit ratings. AIP Conference Proceedings (Vol. 1691, No. 1, p. 050005).

AIP Publishing.

8. Gan, C.P., Pooi, A.H. and Ng, K. H. (2017). Prediction of Future Credit

Rating Using a Non-Markovian Model. AIP Conference Proceedings (Vol.

1830, p. 080002). AIP Publishing.

9. Jakubik, P., & Schmieder, C. (2008). Stress Testing Credit Risk:

Comparison of the Czech Republic and Germany; FSI Award 2008

Winning Paper. Financial Stability Institute, Bank for International

Settlements, Switzerland.

10. Kronwald, C. (2009). Credit Rating and the Impact on Capital Structure.

Munich, GRIN Verlag.

11. Küçüközmen, C. C., & Yüksel, A. (2006). A macroeconometric model for

stress testing credit portfolio. In 13th Annual Conference of the

Multinational Finance Society.

12. Otani, A., Shiratsuka, S., Tsurui, R., & Yamada, T. (2009). Macro stress-

testing on the loan portfolio of Japanese banks. Bank of Japan Working

Paper Series No. 09-E-1.

13. Pooi, A. H. (2012). A model for time series analysis. Applied

Mathematical Sciences, 6(115), 5735-5748.

54 | I S I W S C 2 0 1 9