Page 165 - Special Topic Session (STS) - Volume 4

P. 165

STS577 Md. Sabiruzzaman et al.

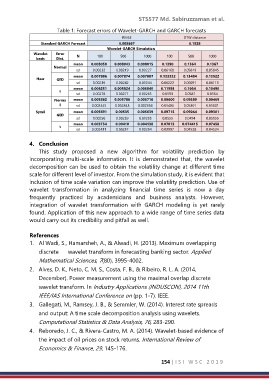

Table 1: Forecast errors of Wavelet-GARCH and GARCH forecasts

RMSE DTW distance

Standard GARCH Forecast 0.008667 0.1528

Wavelet-GARCH Simulation

Wavelet Error

basis Dist. N 100 500 1000 100 500 1000

mean 0.008058 0.008043 0.008015 0.1390 0.1364 0.1367

Normal

sd 0.00232 0.00219 0.00227 0.06168 0.05819 0.05845

mean 0.007886 0.007874 0.007887 0.133332 0.13484 0.13522

Haar GED

sd 0.00236 0.00242 0.00244 0.06222 0.06091 0.06116

mean 0.006251 0.005824 0.005840 0.11593 0.1064 0.10490

t

sd 0.00278 0.00271 0.00263 0.0593 0.0581 0.0564

Norma mean 0.005862 0.005786 0.005716 0.09600 0.09589 0.09469

l sd 0.002445 0.002343 0.002368 0.05486 0.05301 0.05301

Sym8 mean 0.005691 0.00535 0.005639 0.09715 0.09044 0.09301

GED sd 0.00250 0.00239 0.00233 0.0555 0.0494 0.05055

mean 0.003734 0.00410 0.004138 0.07015 0.074415 0.07458

t

sd 0.002431 0.00237 0.00234 0.03997 0.04528 0.04524

4. Conclusion

This study proposed a new algorithm for volatility prediction by

incorporating multi-scale information. It is demonstrated that, the wavelet

decomposition can be used to obtain the volatility change at different time

scale for different level of investor. From the simulation study, it is evident that

inclusion of time scale variation can improve the volatility prediction. Use of

wavelet transformation in analyzing financial time series is now a day

frequently practiced by academicians and business analysts. However,

integration of wavelet transformation with GARCH modeling is yet rarely

found. Application of this new approach to a wide range of time series data

would carry out its credibility and pitfall as well.

References

1. Al Wadi, S., Hamarsheh, A., & Alwadi, H. (2013). Maximum overlapping

discrete wavelet transform in forecasting banking sector. Applied

Mathematical Sciences, 7(80), 3995-4002.

2. Alves, D. K., Neto, C. M. S., Costa, F. B., & Ribeiro, R. L. A. (2014,

December). Power measurement using the maximal overlap discrete

wavelet transform. In Industry Applications (INDUSCON), 2014 11th

IEEE/IAS International Conference on (pp. 1-7). IEEE.

3. Gallegati, M., Ramsey, J. B., & Semmler, W. (2014). Interest rate spreads

and output: A time scale decomposition analysis using wavelets.

Computational Statistics & Data Analysis, 76, 283-290.

4. Reboredo, J. C., & Rivera-Castro, M. A. (2014). Wavelet-based evidence of

the impact of oil prices on stock returns. International Review of

Economics & Finance, 29, 145-176.

154 | I S I W S C 2 0 1 9