Page 21 - Special Topic Session (STS) - Volume 4

P. 21

STS556 Nitin Kumar et al.

(1991) and Arellano and Bover (1995) has been employed to estimate casual

effect of regressor on dependent variable, formulated as follows.

The lagged endogenous variable is represented by yi, t-1 with Xi, t being

matrix of other exogenous variables as explained in previous section.

3. Result

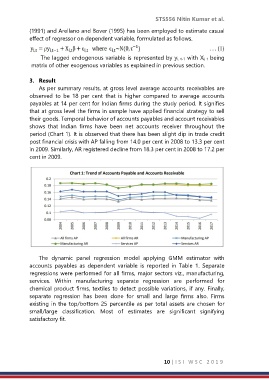

As per summary results, at gross level average accounts receivables are

observed to be 18 per cent that is higher compared to average accounts

payables at 14 per cent for Indian firms during the study period. It signifies

that at gross level the firms in sample have applied financial strategy to sell

their goods. Temporal behavior of accounts payables and account receivables

shows that Indian firms have been net accounts receiver throughout the

period (Chart 1). It is observed that there has been slight dip in trade credit

post financial crisis with AP falling from 14.0 per cent in 2008 to 13.3 per cent

in 2009. Similarly, AR registered decline from 18.3 per cent in 2008 to 17.2 per

cent in 2009.

The dynamic panel regression model applying GMM estimator with

accounts payables as dependent variable is reported in Table 1. Separate

regressions were performed for all firms, major sectors viz., manufacturing,

services. Within manufacturing separate regression are performed for

chemical product firms, textiles to detect possible variations, if any. Finally,

separate regression has been done for small and large firms also. Firms

existing in the top/bottom 25 percentile as per total assets are chosen for

small/large classification. Most of estimates are significant signifying

satisfactory fit.

10 | I S I W S C 2 0 1 9