Page 25 - Special Topic Session (STS) - Volume 4

P. 25

STS556 Nitin Kumar et al.

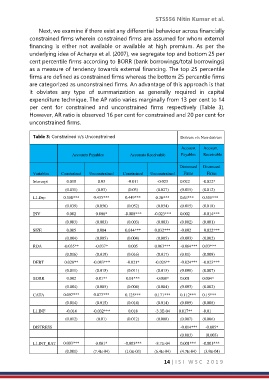

Next, we examine if there exist any differential behaviour across financially

constrained firms wherein constrained firms are assumed for whom external

financing is either not available or available at high premium. As per the

underlying idea of Acharya et al. (2007), we segregate top and bottom 25 per

cent percentile firms according to BORR (bank borrowings/total borrowings)

as a measure of tendency towards external financing. The top 25 percentile

firms are defined as constrained firms whereas the bottom 25 percentile firms

are categorized as unconstrained firms. An advantage of this approach is that

it obviates any type of summarization as generally required in capital

expenditure technique. The AP ratio varies marginally from 13 per cent to 14

per cent for constrained and unconstrained firms respectively (Table 3).

However, AR ratio is observed 16 per cent for constrained and 20 per cent for

unconstrained firms.

Table 3: Constrained v/s Unconstrained Distress v/s Non-distress

Account Account

Accounts Payables Accounts Receivable Payables Receivable

Distressed Distressed

Variables Constrained Unconstrained Constrained Unconstrained Firms Firms

Intercept 0.018 0.03 -0.011 -0.023 0.022 -0.022*

(0.031) (0.03) (0.03) (0.027) (0.015) (0.012)

L1.Dep 0.358*** 0.435*** 0.449*** 0.36*** 0.63*** 0.555***

(0.039) (0.056) (0.052) (0.054) (0.015) (0.018)

INV 0.002 0.006* -0.008*** -0.023*** 0.002 -0.014***

(0.003) (0.003) (0.003) (0.003) (0.002) (0.001)

SIZE 0.005 0.004 0.014*** 0.032*** -0.002 0.022***

(0.004) (0.005) (0.004) (0.005) (0.003) (0.002)

ROA -0.035** -0.037* 0.005 0.063*** -0.064*** 0.03***

(0.016) (0.019) (0.016) (0.017) (0.01) (0.009)

DEBT 0.028** -0.083*** -0.021* -0.026** -0.024*** -0.023***

(0.011) (0.015) (0.011) (0.013) (0.008) (0.007)

BORR 0.002 0.01** 0.01*** -0.008* 0.001 0.004*

(0.004) (0.005) (0.004) (0.004) (0.003) (0.002)

CATA 0.097*** 0.077*** 0.125*** 0.171*** 0.112*** 0.15***

(0.014) (0.015) (0.014) (0.014) (0.009) (0.008)

L1.INF -0.014 -0.032*** 0.018 -3.3E-04 0.017** -0.01

(0.012) (0.01) (0.012) (0.008) (0.007) (0.006)

DISTRESS -0.014*** -0.005*

(0.003) (0.003)

L1.INT_RAT 0.003*** 0.001* -0.003*** -8.7E-04 0.001*** -0.001***

E (0.001) (7.4E-04) (1.0E-03) (6.4E-04) (4.7E-04) (3.9E-04)

14 | I S I W S C 2 0 1 9