Page 23 - Special Topic Session (STS) - Volume 4

P. 23

STS556 Nitin Kumar et al.

compared to more expensive forms of credit (Myers and Majluf, 1984).

Liquidity of firm as captured by current ratio is significant and positive. Higher

liquidity affords higher trade credit liability to a firm. The finding is consistent

as per Bougheas et al. (2009) and Vaidya (2011). Amongst macro indicators

higher interest rate is having a positive influence on account payables. Higher

rates narrow down the rate gap between formal sources of credit and trade

credit leading to greater usage of trade credit that is relatively convenient.

However, the role of both inflation and growth rate is negative dependent

variable.

Continuing with other columns of Table 1, it is found that most of the

results obtained for all the firms hold for other classifications also. Size of

inventory although insignificant for service sector is positive and significant for

manufacturing sector. The service sector like software firms, trade,

communications, and transportation predominantly comprises of intangible

goods where the role of physical inventory is limited. SIZE variable is positive

and significant for chemical product firms, implying larger firms receiving

more trade credit due to their creditworthiness and reputational

considerations with potential buyers (Petersen and Rajan, 1997). Bougheas et

al. (2009) found positive relation of size with both forms of trade credit

although Vaidya (2011) found it significant only for account receivable. Debt

to asset ratio is negative but insignificant for service sector turns to be

negative and significant for entire sample and manufacturing sector also. Bank

borrowing is recorded to be insignificant for most of firm classifications

leading to inconclusive outcome. Inflation is having strong negative impact for

both manufacturing and entire sample. Higher inflation is leading to lesser

trade credit liability due to decline in real value of outstanding credit.

Significant Wald statistics indicate rejection of null of parameter values being

zero.

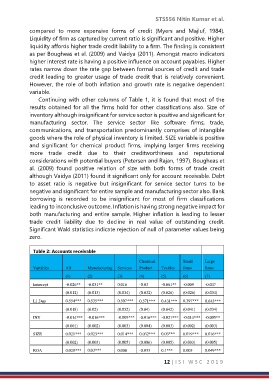

Table 2: Accounts receivable

Chemical Small Large

Variables All Manufacturing Services Product Textiles firms firms

(1) (2) (3) (4) (5) (6) (7)

Intercept -0.026** -0.031** 0.016 -0.03 -0.061** -0.009 -0.047

(0.012) (0.013) (0.034) (0.032) (0.026) (0.026) (0.034)

L1.Dep 0.554*** 0.535*** 0.507*** 0.371*** 0.431*** 0.397*** 0.643***

(0.018) (0.02) (0.052) (0.04) (0.042) (0.041) (0.034)

INV -0.014*** -0.016*** -0.009*** -0.016*** -0.021*** -0.014*** -0.005**

(0.001) (0.002) (0.003) (0.004) (0.003) (0.002) (0.003)

SIZE 0.021*** 0.023*** 0.014*** 0.032*** 0.03*** 0.019*** 0.016***

(0.002) (0.003) (0.005) (0.006) (0.005) (0.003) (0.005)

ROA 0.028*** 0.03*** 0.008 -0.033 0.1*** 0.005 0.049***

12 | I S I W S C 2 0 1 9