Page 150 - Contributed Paper Session (CPS) - Volume 5

P. 150

CPS1159 Philip Hans Franses et al.

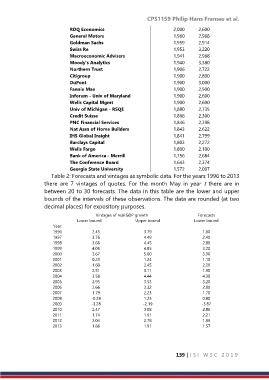

RDQ Economics 2,000 2,600

General Motors 1,960 2,968

Goldman Sachs 1,959 2,914

Swiss Re 1,953 3,220

Macroeconomic Advisers 1,941 2,968

Moody's Analytics 1,940 3,380

Northern Trust 1,906 2,722

Citigroup 1,900 2,800

DuPont 1,900 3,000

Fannie Mae 1,900 2,500

Inforum - Univ of Maryland 1,900 2,600

Wells Capital Mgmt 1,900 2,600

Univ of Michigan - RSQE 1,880 2,735

Credit Suisse 1,868 2,300

PNC Financial Services 1,846 2,398

Nat Assn of Home Builders 1,843 2,622

IHS Global Insight 1,841 2,799

Barclays Capital 1,803 2,272

Wells Fargo 1,800 2,100

Bank of America - Merrill 1,756 2,684

The Conference Board 1,643 2,374

Georgia State University 1,572 2,007

Table 2: Forecasts and vintages as symbolic data. For the years 1996 to 2013

there are 7 vintages of quotes. For the month May in year t there are in

between 20 to 30 forecasts. The data in this table are the lower and upper

bounds of the intervals of these observations. The data are rounded (at two

decimal places) for expository purposes.

Vintages of real GDP growth Forecasts

Lower bound Upper bound Lower bound

Year

1996 2.45 3.79 1.80

1997 3.76 4.49 2.40

1998 3.66 4.45 2.80

1999 4.05 4.85 3.20

2000 3.67 5.00 3.90

2001 0.23 1.24 1.10

2002 1.60 2.45 2.20

2003 2.51 3.11 1.90

2004 3.58 4.44 4.30

2005 2.95 3.53 3.20

2006 2.66 3.32 2.80

2007 1.79 2.23 1.70

2008 -0.28 1.23 0.80

2009 -3.28 -2.19 -3.87

2010 2.47 3.08 2.86

2011 1.74 1.91 2.21

2012 2.04 2.78 1.99

2013 1.86 1.91 1.57

139 | I S I W S C 2 0 1 9