Page 143 - Contributed Paper Session (CPS) - Volume 7

P. 143

CPS2048 Md Zobaer H. et al.

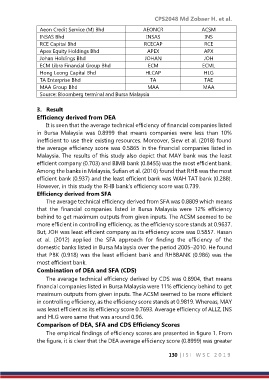

Aeon Credit Service (M) Bhd AEONCR ACSM

INSAS Bhd INSAS INS

RCE Capital Bhd RCECAP RCE

Apex Equity Holdings Bhd APEX APX

Johan Holdings Bhd JOHAN JOH

ECM Libra Financial Group Bhd ECM ECML

Hong Leong Capital Bhd HLCAP HLG

TA Enterprise Bhd TA TAE

MAA Group Bhd MAA MAA

Source: Bloomberg terminal and Bursa Malaysia

3. Result

Efficiency derived from DEA

It is seen that the average technical efficiency of financial companies listed

in Bursa Malaysia was 0.8999 that means companies were less than 10%

inefficient to use their existing resources. Moreover, Siew et al. (2018) found

the average efficiency score was 0.5865 in the financial companies listed in

Malaysia. The results of this study also depict that MAY bank was the least

efficient company (0.703) and BIMB bank (0.8455) was the most efficient bank.

Among the banks in Malaysia, Sufian et al. (2016) found that RHB was the most

efficient bank (0.937) and the least efficient bank was WAH TAT bank (0.288).

However, in this study the RHB bank’s efficiency score was 0.739.

Efficiency derived from SFA

The average technical efficiency derived from SFA was 0.8809 which means

that the financial companies listed in Bursa Malaysia were 12% efficiency

behind to get maximum outputs from given inputs. The ACSM seemed to be

more efficient in controlling efficiency, as the efficiency score stands at 0.9637.

But, JOH was least efficient company as its efficiency score was 0.5857. Hasan

et al. (2012) applied the SFA approach for finding the efficiency of the

domestic banks listed in Bursa Malaysia over the period 2005–2010. He found

that PBK (0.918) was the least efficient bank and RHBBANK (0.986) was the

most efficient bank.

Combination of DEA and SFA (CDS)

The average technical efficiency derived by CDS was 0.8904, that means

financial companies listed in Bursa Malaysia were 11% efficiency behind to get

maximum outputs from given inputs. The ACSM seemed to be more efficient

in controlling efficiency, as the efficiency score stands at 0.9819. Whereas, MAY

was least efficient as its efficiency score 0.7693. Average efficiency of ALLZ, INS

and HLG were same that was around 0.96.

Comparison of DEA, SFA and CDS Efficiency Scores

The empirical findings of efficiency scores are presented in figure 1. From

the figure, it is clear that the DEA average efficiency score (0.8999) was greater

130 | I S I W S C 2 0 1 9