Page 304 - Contributed Paper Session (CPS) - Volume 7

P. 304

CPS2105 Hermansah et al.

X ̂ N+h = [φ(B) − 1]S ̃ J 0 ,N+h + θ(B)e N+h + ∑ J 0 ([φ j (B) − 1]D ̃ j,N+h + θ j (B)e N+h ) (15)

j=0

3. Result

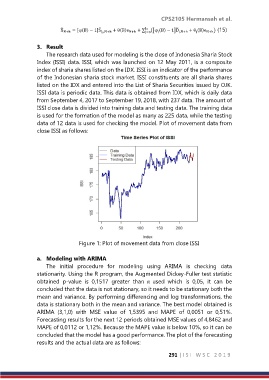

The research data used for modeling is the close of Indonesia Sharia Stock

Index (ISSI) data. ISSI, which was launched on 12 May 2011, is a composite

index of sharia shares listed on the IDX. ISSI is an indicator of the performance

of the Indonesian sharia stock market. ISSI constituents are all sharia shares

listed on the IDX and entered into the List of Sharia Securities issued by OJK.

ISSI data is periodic data. This data is obtained from IDX, which is daily data

from September 4, 2017 to September 19, 2018, with 237 data. The amount of

ISSI close data is divided into training data and testing data. The training data

is used for the formation of the model as many as 225 data, while the testing

data of 12 data is used for checking the model. Plot of movement data from

close ISSI as follows:

Figure 1: Plot of movement data from close ISSI

a. Modeling with ARIMA

The initial procedure for modeling using ARIMA is checking data

stationarity. Using the R program, the Augmented Dickey-Fuller test statistic

obtained p-value is 0,1517 greater than α used which is 0,05, it can be

concluded that the data is not stationary, so it needs to be stationary both the

mean and variance. By performing differencing and log transformations, the

data is stationary both in the mean and variance. The best model obtained is

ARIMA (3,1,0) with MSE value of 1,5395 and MAPE of 0,0051 or 0,51%.

Forecasting results for the next 12 periods obtained MSE values of 4,8462 and

MAPE of 0,0112 or 1,12%. Because the MAPE value is below 10%, so it can be

concluded that the model has a good performance. The plot of the forecasting

results and the actual data are as follows:

291 | I S I W S C 2 0 1 9