Page 221 - Contributed Paper Session (CPS) - Volume 6

P. 221

CPS1892 Yang Xinhong

collect the proportion of "NOF" loan capital according to the source channels

in the survey.

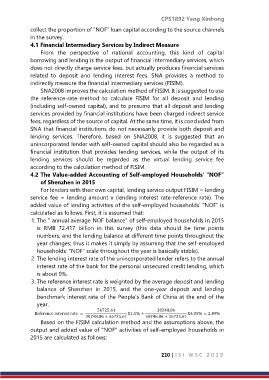

4.1 Financial Intermediary Services by Indirect Measure

From the perspective of national accounting, this kind of capital

borrowing and lending is the output of financial intermediary services, which

does not directly charge service fees, but actually produces financial services

related to deposit and lending interest fees. SNA provides a method to

indirectly measure the financial intermediary services (FISIM).

SNA2008 improves the calculation method of FISIM. It is suggested to use

the reference-rate-method to calculate FISIM for all deposit and lending

(including self-owned capital), and to presume that all deposit and lending

services provided by financial institutions have been charged indirect service

fees, regardless of the source of capital. At the same time, it is concluded from

SNA that financial institutions do not necessarily provide both deposit and

lending services. Therefore, based on SNA2008, it is suggested that an

unincorporated lender with self-owned capital should also be regarded as a

financial institution that provides lending services, while the output of its

lending services should be regarded as the virtual lending service fee

according to the calculation method of FISIM.

4.2 The Value-added Accounting of Self-employed Households' "NOF"

of Shenzhen in 2015

For lenders with their own capital, lending service output FISIM = lending

service fee = lending amount x (lending interest rate-reference rate). The

added value of lending activities of the self-employed households' "NOF" is

calculated as follows. First, it is assumed that:

1. The " annual average NOF balance" of self-employed households in 2015

is RMB 72.417 billion in this survey (this data should be time points

numbers, and the lending balance at different time points throughout the

year changes; thus it makes it simply by assuming that the self-employed

households' "NOF" scale throughout the year is basically stable).

2. The lending interest rate of the unincorporated lender refers to the annual

interest rate of the bank for the personal unsecured credit lending, which

is about 9%.

3. The reference interest rate is weighted by the average deposit and lending

balance of Shenzhen in 2015, and the one-year deposit and lending

benchmark interest rate of the People's Bank of China at the end of the

year.

56725.61 30248.86

Reference interest rate = X1.5% + X4.35% = 2.49%

30248.86 + 56725.61 30248.86 + 56725.61

Based on the FISIM calculation method and the assumptions above, the

output and added value of "NOF" activities of self-employed households in

2015 are calculated as follows:

210 | I S I W S C 2 0 1 9