Page 84 - Invited Paper Session (IPS) - Volume 2

P. 84

IPS184 Kimiaki S. et al.

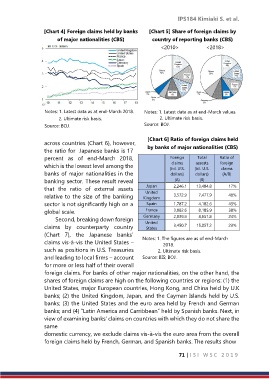

[Chart 4] Foreign claims held by banks [Chart 5] Share of foreign claims by

of major nationalities (CBS) country of reporting banks (CBS)

<2010> <2018>

Notes: 1. Latest data as at end-March 2018. Notes: 1. Latest data as at end-March values.

2. Ultimate risk basis. 2. Ultimate risk basis.

Source: BOJ. Source: BOJ.

[Chart 6] Ratio of foreign claims held

across countries (Chart 6), however,

the ratio for Japanese banks is 17 by banks of major nationalities (CBS)

percent as of end-March 2018, Foreign Total Ratio of

assests

claims

which is the lowest level among the (bil. U.S. (bil. U.S. foreign

claims

banks of major nationalities in the dollars) dollars) (A/B)

banking sector. These result reveal (A) (B)

Japan

that the ratio of external assets United 2,246.1 13,484.8 17%

relative to the size of the banking Kingdom 3,572.9 7,477.9 48%

sector is not significantly high on a Spain 1,787.2 4,182.6 43%

global scale. France 3,082.6 8,185.9 38%

Second, breaking down foreign Germany 2,039.9 8,651.8 24%

United

claims by counterparty country States 3,450.7 15,057.2 23%

(Chart 7), the Japanese banks’ Notes: 1. The figures are as of end-March

claims vis-à-vis the United States – 2018.

such as positions in U.S. Treasuries 2. Ultimate risk basis.

and leading to local firms – account Source: BIS; BOJ.

for more or less half of their overall

foreign claims. For banks of other major nationalities, on the other hand, the

shares of foreign claims are high on the following countries or regions: (1) the

United States, major European countries, Hong Kong, and China held by U.K

banks; (2) the United Kingdom, Japan, and the Cayman Islands held by U.S.

banks; (3) the United States and the euro area held by French and German

banks; and (4) “Latin America and Carribbean” held by Spanish banks. Next, in

view of examining banks’ claims on countries with which they do not share the

same

domestic currency, we exclude claims vis-à-vis the euro area from the overall

foreign claims held by French, German, and Spanish banks. The results show

71 | I S I W S C 2 0 1 9