Page 85 - Invited Paper Session (IPS) - Volume 2

P. 85

IPS184 Kimiaki S. et al.

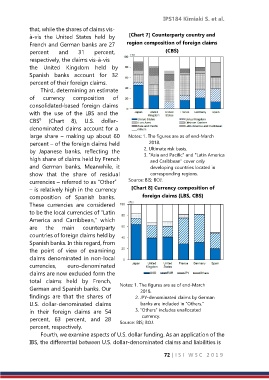

that, while the shares of claims vis-

à-vis the United States held by [Chart 7] Counterparty country and

French and German banks are 27 region composition of foreign claims

percent and 31 percent, (CBS)

respectively, the claims vis-à-vis

the United Kingdom held by

Spanish banks account for 32

percent of their foreign claims.

Third, determining an estimate

of currency composition of

consolidated-based foreign claims

with the use of the LBS and the

9

CBS (Chart 8), U.S. dollar-

denominated claims account for a

large share – making up about 60 Notes: 1. The figures are as of end-March

percent – of the foreign claims held 2018.

by Japanese banks, reflecting the 2. Ultimate risk basis.

3. "Asia and Pacific" and "Latin America

high share of claims held by French and Caribbean" cover only

and German banks. Meanwhile, it developing countries located in

show that the share of residual corresponding regions.

currencies – referred to as “Other” Source: BIS; BOJ.

– is relatively high in the currency [Chart 8] Currency composition of

composition of Spanish banks. foreign claims (LBS, CBS)

These currencies are considered

to be the local currencies of “Latin

America and Carribbean,” which

are the main counterparty

countries of foreign claims held by

Spanish banks. In this regard, from

the point of view of examining

claims denominated in non-local

currencies, euro-denominated

claims are now excluded form the

total claims held by French,

German and Spanish banks. Our Notes: 1. The figures are as of end-March

2018.

findings are that the shares of 2. JPY-denominated claims by German

U.S. dollar-denominated claims banks are included in “Others.”

in their foreign claims are 54 3. “Others” includes unallocated

percent, 63 percent, and 28 currency.

percent, respectively. Source: BIS; BOJ.

Fourth, we examine aspects of U.S. dollar funding. As an application of the

IBS, the differential between U.S. dollar-denominated claims and liabilities is

72 | I S I W S C 2 0 1 9