Page 86 - Invited Paper Session (IPS) - Volume 2

P. 86

IPS184 Kimiaki S. et al.

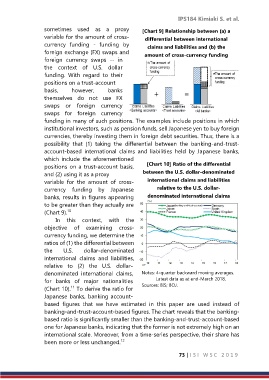

sometimes used as a proxy [Chart 9] Relationship between (a) a

variable for the amount of cross- differential between international

currency funding - funding by claims and liabilities and (b) the

foreign exchange (FX) swaps and amount of cross-currency funding

foreign currency swaps -- in

the context of U.S. dollar

funding. With regard to their

positions on a trust-account

basis, however, banks

themselves do not use FX

swaps or foreign currency

swaps for foreign currency

funding in many of such positions. The examples include positions in which

institutional investors, such as pension funds, sell Japanese yen to buy foreign

currencies, thereby investing them in foreign debt securities. Thus, there is a

possibility that (1) taking the differential between the banking-and-trust-

account-based international claims and liabilities held by Japanese banks,

which include the aforementioned

positions on a trust-account basis, [Chart 10] Ratio of the differential

and (2) using it as a proxy between the U.S. dollar-denominated

variable for the amount of cross- international claims and liabilities

currency funding by Japanese relative to the U.S. dollar-

banks, results in figures appearing denominated international claims

to be greater than they actually are

10

(Chart 9).

In this context, with the

objective of examining cross-

currency funding, we determine the

ratios of (1) the differential between

the U.S. dollar-denominated

international claims and liabilities,

relative to (2) the U.S. dollar-

denominated international claims, Notes: 4-quarter backward moving averages.

for banks of major nationalities Latest data as at end-March 2018.

11

(Chart 10). To derive the ratio for Sources: BIS; BOJ.

Japanese banks, banking account-

based figures that we have estimated in this paper are used instead of

banking-and-trust-account-based figures. The chart reveals that the banking-

based ratio is significantly smaller than the banking-and-trust-account-based

one for Japanese banks, indicating that the former is not extremely high on an

international scale. Moreover, from a time-series perspective, their share has

been more or less unchanged. 12

73 | I S I W S C 2 0 1 9