Page 209 - Special Topic Session (STS) - Volume 1

P. 209

STS425 Arifah B. et al.

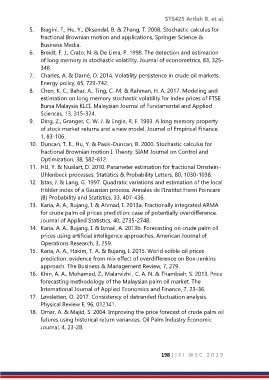

5. Biagini, F., Hu, Y., Øksendal, B. & Zhang, T. 2008. Stochastic calculus for

fractional Brownian motion and applications, Springer Science &

Business Media.

6. Breidt, F. J., Crato, N. & De Lima, P. 1998. The detection and estimation

of long memory in stochastic volatility. Journal of econometrics, 83, 325-

348.

7. Charles, A. & Darné, O. 2014. Volatility persistence in crude oil markets.

Energy policy, 65, 729-742.

8. Chen, K. C., Bahar, A., Ting, C.-M. & Rahman, H. A. 2017. Modeling and

estimation on long memory stochastic volatility for index prices of FTSE

Bursa Malaysia KLCI. Malaysian Journal of Fundamental and Applied

Sciences, 13, 315-324.

9. Ding, Z., Granger, C. W. J. & Engle, R. F. 1993. A long memory property

of stock market returns and a new model. Journal of Empirical Finance,

1, 83-106.

10. Duncan, T. E., Hu, Y. & Pasik-Duncan, B. 2000. Stochastic calculus for

fractional Brownian motion I. Theory. SIAM Journal on Control and

Optimization, 38, 582-612.

11. HU, Y. & Nualart, D. 2010. Parameter estimation for fractional Ornstein–

Uhlenbeck processes. Statistics & Probability Letters, 80, 1030-1038.

12. Istas, J. & Lang, G. 1997. Quadratic variations and estimation of the local

Hölder index of a Gaussian process. Annales de l'Institut Henri Poincare

(B) Probability and Statistics, 33, 407-436.

13. Karia, A. A., Bujang, I. & Ahmad, I. 2013a. Fractionally integrated ARMA

for crude palm oil prices prediction: case of potentially overdifference.

Journal of Applied Statistics, 40, 2735-2748.

14. Karia, A. A., Bujang, I. & Ismail, A. 2013b. Forecasting on crude palm oil

prices using artificial intelligence approaches. American Journal of

Operations Research, 3, 259.

15. Karia, A. A., Hakim, T. A. & Bujang, I. 2015. World edible oil prices

prediction: evidence from mix effect of overdifference on Box-Jenkins

approach. The Business & Management Review, 7, 279.

16. Khin, A. A., Mohamed, Z., Malarvizhi , C. A. N. & Thambiah, S. 2013. Price

forecasting methodology of the Malaysian palm oil market. The

International Journal of Applied Economics and Finance, 7, 23-36.

17. Løvsletten, O. 2017. Consistency of detrended fluctuation analysis.

Physical Review E, 96, 012141.

18. Omar, A. & Majid, S. 2004. Improving the price forecast of crude palm oil

futures using historical return variances. Oil Palm Industry Economic

Journal, 4, 23-28.

198 | I S I W S C 2 0 1 9