Page 151 - Special Topic Session (STS) - Volume 2

P. 151

STS474 Gigih F. et al.

3. Result

3.1 Breakpoint Analysis of US Regional Data

3.1.1 By Spatially-Independent Model

st

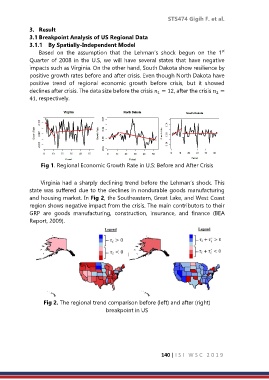

Based on the assumption that the Lehman’s shock begun on the 1

Quarter of 2008 in the U.S, we will have several states that have negative

impacts such as Virginia. On the other hand, South Dakota show resilience by

positive growth rates before and after crisis. Even though North Dakota have

positive trend of regional economic growth before crisis, but it showed

declines after crisis. The data size before the crisis = 12, after the crisis =

1

2

41, respectively.

Fig 1. Regional Economic Growth Rate in U.S: Before and After Crisis

Virginia had a sharply declining trend before the Lehman’s shock. This

state was suffered due to the declines in nondurable goods manufacturing

and housing market. In Fig 2, the Southeastern, Great Lake, and West Coast

region shows negative impact from the crisis. The main contributors to their

GRP are goods manufacturing, construction, insurance, and finance (BEA

Report, 2009).

Fig 2. The regional trend comparison before (left) and after (right)

breakpoint in US

140 | I S I W S C 2 0 1 9