Page 149 - Special Topic Session (STS) - Volume 2

P. 149

STS474 Gigih F. et al.

values reported declined from -3.5% in 2008 to -33.1% in 2009 (MOF Press

Release, 2012).

Kawai and Takagi (2009) have shown that this occurred by the increasing

of Japan’s export to gross domestic product (GDP) ratio and trade openness.

Due to the declining of demand from US, then Japan had faced lower total

export. This decline is also affected financial institutions’ core profitability from

trade credit and financing as the regional capital is not kept up the increasing

off risk asset (BOJ Financial System Report, 2008). Demirer et al. (2017) also

show that the Japanese banks have strong connection globally impacted the

spread volatility across bank stocks, especially with US banks.

In this research, we conducted further investigation for the impact of

Lehman’s shock towards US and Japan regional economic growth. By using

this approach, we got a detailed illustration of how the shock transmitted

within country.

2. Methodology

2.1 Data and Target Variable

We used the real gross regional product (GRP) based on production

approach as the main dataset. The United States data were retrieved from

regional statistics in Bureau Economic Analysis (BEA) and we apply quarterly

nd

st

data from 1 Quarter of 2005 until 2 Quarter of 2018 for 51 states (including

District of Columbia). On the other hand, for Japan we use annually GRP data

from Economic and Social Research Institute, Cabinet Office for 47 prefectures

from 2001 until 2014.

Based on Reinhart & Rogoff (2008) and Bank for International Settlement

st

(BIS) Report (2009) we select the 1 quarter of 2008 as the breakpoint in the

US. On the other hand, following Filardo et al. (2009) and Kawai & Takagi

(2009), we select 2008 as the breakpoint for Japan regional data.

2.2 Empirical Model

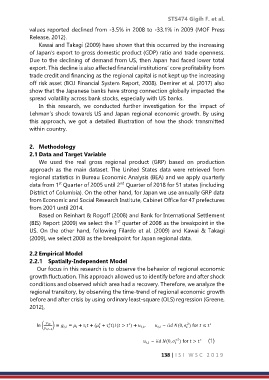

2.2.1 Spatially-Independent Model

Our focus in this research is to observe the behavior of regional economic

growth fluctuation. This approach allowed us to identify before and after shock

conditions and observed which area had a recovery. Therefore, we analyze the

regional transitory, by observing the time-trend of regional economic growth

before and after crisis by using ordinary least-square (OLS) regression (Greene,

2012),

∗

∗

∗

2

∗

ln ( , ) ≡ , = + + ( + )( > ) + , , , ∼ (0, ) for ≤

,−1

∗ 2

∗

, ∼ (0, ) for > (1)

138 | I S I W S C 2 0 1 9