Page 354 - Special Topic Session (STS) - Volume 3

P. 354

STS550 Angelia L. Grant et al.

As the forecasting horizon increases, the performance of the AR(2) models

for some components deteriorates relative to the AIDS. For example, at the

three-year-ahead horizon, the forecast for the fuels and lubricants component

of the benchmark model is 53 per cent better compared to the standard AR(2)

model. In contrast, the relative price model with the linear time trend

continues to perform relatively well for most of the components.

Consequently, it can generally be concluded that, at shorter forecasting time

horizons, models that capture short-run dynamics perform well, but that, at

longer horizons, models with trend terms and relative prices tend to perform

better.

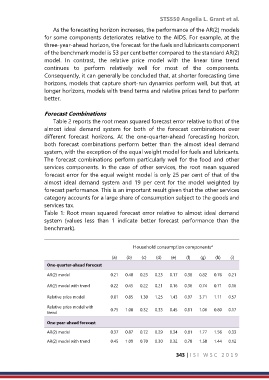

Forecast Combinations

Table 2 reports the root mean squared forecast error relative to that of the

almost ideal demand system for both of the forecast combinations over

different forecast horizons. At the one-quarter-ahead forecasting horizon,

both forecast combinations perform better than the almost ideal demand

system, with the exception of the equal weight model for fuels and lubricants.

The forecast combinations perform particularly well for the food and other

services components. In the case of other services, the root mean squared

forecast error for the equal weight model is only 25 per cent of that of the

almost ideal demand system and 19 per cent for the model weighted by

forecast performance. This is an important result given that the other services

category accounts for a large share of consumption subject to the goods and

services tax.

Table 1: Root mean squared forecast error relative to almost ideal demand

system (values less than 1 indicate better forecast performance than the

benchmark).

Household consumption components*

(a) (b) (c) (d) (e) (f) (g) (h) (i)

One-quarter-ahead forecast

AR(2) model 0.21 0.40 0.23 0.23 0.17 0.38 0.82 0.76 0.21

AR(2) model with trend 0.22 0.45 0.22 0.21 0.16 0.36 0.74 0.71 0.16

Relative price model 0.81 0.85 1.30 1.25 1.43 0.97 3.71 1.11 0.57

Relative price model with 0.75 1.08 0.32 0.33 0.45 0.81 1.06 0.80 0.17

trend

One-year-ahead forecast

AR(2) model 0.37 0.87 0.72 0.29 0.34 0.81 1.77 1.56 0.33

AR(2) model with trend 0.45 1.09 0.70 0.30 0.32 0.78 1.58 1.44 0.12

343 | I S I W S C 2 0 1 9