Page 355 - Special Topic Session (STS) - Volume 3

P. 355

STS550 Angelia L. Grant et al.

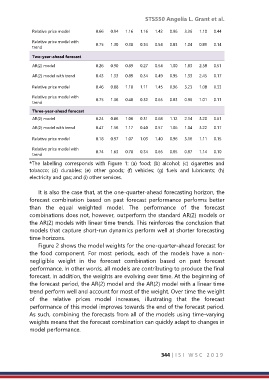

Relative price model 0.66 0.94 1.16 1.16 1.42 0.96 3.36 1.10 0.44

Relative price model with 0.75 1.30 0.38 0.34 0.54 0.83 1.04 0.89 0.14

trend

Two-year-ahead forecast

AR(2) model 0.26 0.90 0.89 0.27 0.54 1.00 1.83 2.58 0.51

AR(2) model with trend 0.43 1.33 0.89 0.34 0.49 0.95 1.33 2.45 0.17

Relative price model 0.46 0.88 1.10 1.11 1.45 0.96 3.23 1.08 0.33

Relative price model with 0.75 1.36 0.40 0.32 0.65 0.83 0.96 1.01 0.11

trend

Three-year-ahead forecast

AR(2) model 0.24 0.86 1.06 0.31 0.68 1.12 2.14 3.20 0.61

AR(2) model with trend 0.47 1.56 1.17 0.40 0.57 1.06 1.04 3.22 0.17

Relative price model 0.18 0.97 1.07 1.03 1.40 0.96 3.16 1.11 0.15

Relative price model with 0.74 1.63 0.78 0.34 0.65 0.85 0.87 1.14 0.10

trend

*The labelling corresponds with Figure 1: (a) food; (b) alcohol; (c) cigarettes and

tobacco; (d) durables; (e) other goods; (f) vehicles; (g) fuels and lubricants; (h)

electricity and gas; and (i) other services.

It is also the case that, at the one-quarter-ahead forecasting horizon, the

forecast combination based on past forecast performance performs better

than the equal weighted model. The performance of the forecast

combinations does not, however, outperform the standard AR(2) models or

the AR(2) models with linear time trends. This reinforces the conclusion that

models that capture short-run dynamics perform well at shorter forecasting

time horizons.

Figure 2 shows the model weights for the one-quarter-ahead forecast for

the food component. For most periods, each of the models have a non-

negligible weight in the forecast combination based on past forecast

performance. In other words, all models are contributing to produce the final

forecast. In addition, the weights are evolving over time. At the beginning of

the forecast period, the AR(2) model and the AR(2) model with a linear time

trend perform well and account for most of the weight. Over time the weight

of the relative prices model increases, illustrating that the forecast

performance of this model improves towards the end of the forecast period.

As such, combining the forecasts from all of the models using time-varying

weights means that the forecast combination can quickly adapt to changes in

model performance.

344 | I S I W S C 2 0 1 9