Page 27 - Special Topic Session (STS) - Volume 4

P. 27

STS556 Nitin Kumar et al.

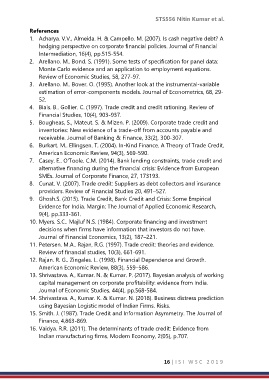

References

1. Acharya. V.V., Almeida. H. & Campello. M. (2007). Is cash negative debt? A

hedging perspective on corporate financial policies. Journal of Financial

Intermediation, 16(4), pp.515-554.

2. Arellano. M.. Bond. S. (1991). Some tests of specification for panel data:

Monte Carlo evidence and an application to employment equations.

Review of Economic Studies, 58, 277-97.

3. Arellano. M.. Bover. O. (1995). Another look at the instrumental-variable

estimation of error-components models. Journal of Econometrics, 68, 29-

52.

4. Biais. B.. Gollier. C. (1997). Trade credit and credit rationing. Review of

Financial Studies, 10(4), 903-937.

5. Bougheas, S., Mateut. S. & Mizen. P. (2009). Corporate trade credit and

inventories: New evidence of a trade-off from accounts payable and

receivable. Journal of Banking & Finance, 33(2), 300-307.

6. Burkart. M.. Ellingsen. T. (2004). In-Kind Finance. A Theory of Trade Credit,

American Economic Review, 94(3), 569-590.

7. Casey. E.. O'Toole. C.M. (2014). Bank lending constraints, trade credit and

alternative financing during the financial crisis: Evidence from European

SMEs. Journal of Corporate Finance, 27, 173193.

8. Cunat. V. (2007). Trade credit: Suppliers as debt collectors and insurance

providers. Review of Financial Studies 20, 491–527.

9. Ghosh.S. (2015). Trade Credit, Bank Credit and Crisis: Some Empirical

Evidence for India. Margin: The Journal of Applied Economic Research,

9(4), pp.333-361.

10. Myers. S.C.. Majluf N.S. (1984). Corporate financing and investment

decisions when firms have information that investors do not have.

Journal of Financial Economics, 13(2), 187–221.

11. Petersen. M.A.. Rajan, R.G. (1997). Trade credit: theories and evidence.

Review of financial studies, 10(3), 661-691.

12. Rajan. R. G.. Zingales. L. (1998). Financial Dependence and Growth.

American Economic Review, 88(3), 559–586.

13. Shrivastava. A., Kumar. N. & Kumar. P. (2017). Bayesian analysis of working

capital management on corporate profitability: evidence from India.

Journal of Economic Studies, 44(4), pp.568-584.

14. Shrivastava. A., Kumar. K. & Kumar. N. (2018). Business distress prediction

using Bayesian Logistic model of Indian Firms. Risks.

15. Smith. J. (1987). Trade Credit and Information Asymmetry. The Journal of

Finance, 4,863-869.

16. Vaidya. R.R. (2011). The determinants of trade credit: Evidence from

Indian manufacturing firms. Modern Economy, 2(05), p.707.

16 | I S I W S C 2 0 1 9