Page 81 - Contributed Paper Session (CPS) - Volume 4

P. 81

CPS2129 Matilde Bini et al.

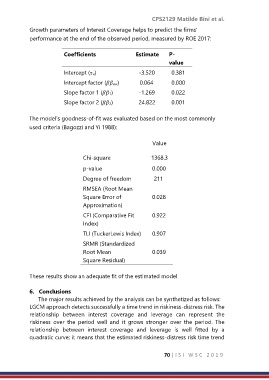

Growth parameters of Interest Coverage helps to predict the firms’

performance at the end of the observed period, measured by ROE 2017:

Coefficients Estimate P-

value

Intercept () -3.520 0.381

Intercept factor () 0.064 0.000

Slope factor 1 (1) -1.269 0.022

Slope factor 2 (2) 24.822 0.001

The model’s goodness-of-fit was evaluated based on the most commonly

used criteria (Bagozzi and Yi 1988):

Value

Chi-square 1368.3

p-value 0.000

Degree of freedom 211

RMSEA (Root Mean

Square Error of 0.028

Approximation)

CFI (Comparative Fit 0.922

Index)

TLI (TuckerLewis Index) 0.907

SRMR (Standardized

Root Mean 0.039

Square Residual)

These results show an adequate fit of the estimated model

6. Conclusions

The major results achieved by the analysis can be synthetized as follows:

LGCM approach detects successfully a time trend in riskiness-distress risk. The

relationship between interest coverage and leverage can represent the

riskiness over the period well and it grows stronger over the period. The

relationship between interest coverage and leverage is well fitted by a

quadratic curve; it means that the estimated riskiness-distress risk time trend

70 | I S I W S C 2 0 1 9