Page 312 - Invited Paper Session (IPS) - Volume 1

P. 312

IPS155 Stefan B. et al.

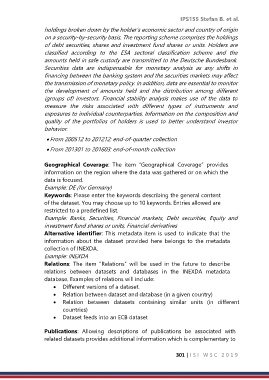

holdings broken down by the holder’s economic sector and country of origin

on a security-by-security basis. The reporting scheme comprises the holdings

of debt securities, shares and investment fund shares or units. Holders are

classified according to the ESA sectoral classification scheme and the

amounts held in safe custody are transmitted to the Deutsche Bundesbank.

Securities data are indispensable for monetary analysis as any shifts in

financing between the banking system and the securities markets may affect

the transmission of monetary policy. In addition, data are essential to monitor

the development of amounts held and the distribution among different

(groups of) investors. Financial stability analysis makes use of the data to

measure the risks associated with different types of instruments and

exposures to individual counterparties. Information on the composition and

quality of the portfolios of holders is used to better understand investor

behavior.

• From 200512 to 201212: end-of-quarter collection

• From 201301 to 201603: end-of-month collection

Geographical Coverage: The item “Geographical Coverage” provides

information on the region where the data was gathered or on which the

data is focused.

Example: DE (for Germany)

Keywords: Please enter the keywords describing the general content

of the dataset. You may choose up to 10 keywords. Entries allowed are

restricted to a predefined list.

Example: Banks, Securities, Financial markets, Debt securities, Equity and

investment fund shares or units, Financial derivatives

Alternative identifier: This metadata item is used to indicate that the

information about the dataset provided here belongs to the metadata

collection of INEXDA.

Example: INEXDA

Relations: The item “Relations” will be used in the future to describe

relations between datasets and databases in the INEXDA metadata

database. Examples of relations will include:

• Different versions of a dataset.

• Relation between dataset and database (in a given country)

• Relation between datasets containing similar units (in different

countries)

• Dataset feeds into an ECB dataset

Publications: Allowing descriptions of publications be associated with

related datasets provides additional information which is complementary to

301 | I S I W S C 2 0 1 9