Page 414 - Invited Paper Session (IPS) - Volume 1

P. 414

IPS173 Tatiana Mosquera Yon et al.

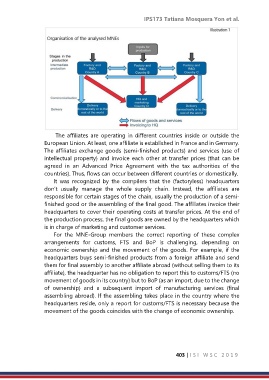

The affiliates are operating in different countries inside or outside the

European Union. At least, one affiliate is established in France and in Germany.

The affiliates exchange goods (semi-finished products) and services (use of

intellectual property) and invoice each other at transfer prices (that can be

agreed in an Advanced Price Agreement with the tax authorities of the

countries). Thus, flows can occur between different countries or domestically.

It was recognized by the compilers that the (factoryless) headquarters

don’t usually manage the whole supply chain. Instead, the affiliates are

responsible for certain stages of the chain, usually the production of a semi-

finished good or the assembling of the final good. The affiliates invoice their

headquarters to cover their operating costs at transfer prices. At the end of

the production process, the final goods are owned by the headquarters which

is in charge of marketing and customer services.

For the MNE-Group members the correct reporting of these complex

arrangements for customs, FTS and BoP is challenging, depending on

economic ownership and the movement of the goods. For example, if the

headquarters buys semi-finished products from a foreign affiliate and send

them for final assembly to another affiliate abroad (without selling them to its

affiliate), the headquarter has no obligation to report this to customs/FTS (no

movement of goods in its country) but to BoP (as an import, due to the change

of ownership) and a subsequent import of manufacturing services (final

assembling abroad). If the assembling takes place in the country where the

headquarters reside, only a report for customs/FTS is necessary because the

movement of the goods coincides with the change of economic ownership.

403 | I S I W S C 2 0 1 9