Page 421 - Special Topic Session (STS) - Volume 3

P. 421

STS552 Natalia Nehrebecka

borrowers. In contrast to debt securities that represent concentrated markets,

with several banks holding large shares of debt securities. Over half of the off-

balance sheet exposure was, however, open credit lines.

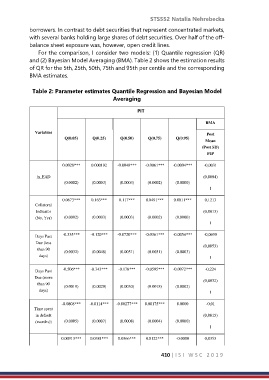

For the comparison, I consider two models: (1) Quantile regression (QR)

and (2) Bayesian Model Averaging (BMA). Table 2 shows the estimation results

of QR for the 5th, 25th, 50th, 75th and 95th per centile and the corresponding

BMA estimates.

Table 2: Parameter estimates Quantile Regression and Bayesian Model

Averaging

PIT

BMA

Variables Post

Q(0.05) Q(0.25) Q(0.50) Q(0.75) Q(0.95)

Mean

(Post SD)

PIP

0.0028*** 0.000192 -0.0048*** -0.0061*** -0.0004*** -0,0031

ln_EAD (0,0004)

(0.0002) (0.0003) (0.0003) (0.0002) (0.0000)

1

0.0673*** 0.163*** 0.117*** 0.0491*** 0.0011*** 0,1213

Collateral

Indicator (0,0013)

(No, Yes) (0.0002) (0.0003) (0.0003) (0.0002) (0.0000)

1

-0.335*** -0.120*** -0.0720*** -0.0361*** -0.0054*** -0,0699

Days Past

Due (less (0,0053)

than 90 (0.0032) (0.0048) (0.0051) (0.0031) (0.0003)

days) 1

-0.506*** -0.343*** -0.178*** -0.0595*** -0.0072*** -0,224

Days Past

Due (more

(0,0032)

than 90 (0.0019) (0.0029) (0.0030) (0.0018) (0.0002)

days)

1

-0.0808*** -0.0114*** -0.00277*** 0.00175*** 0.0000 -0,01

Time spent

in default (0,0015)

(months)) (0.0005) (0.0007) (0.0008) (0.0004) (0.0000)

1

0.00913*** 0.0381*** 0.0366*** 0.0122*** -0.0000 0,0353

410 | I S I W S C 2 0 1 9