Page 145 - Contributed Paper Session (CPS) - Volume 2

P. 145

CPS1474 Jing R. et al.

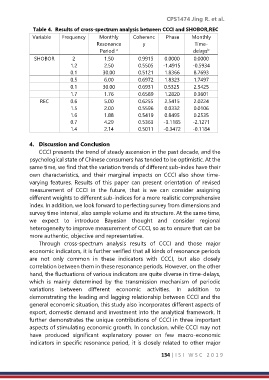

Table 4. Results of cross-spectrum analysis between CCCI and SHOBOR,REC

Variable Frequency Monthly Coherenc Phase Monthly

Resonance y Time-

Period delays

b

a

SHOBOR 2 1.50 0.9915 0.0000 0.0000

1.2 2.50 0.5505 -1.4915 -0.5934

0.1 30.00 0.5121 1.8366 8.7693

0.5 6.00 0.6972 1.8323 1.7497

0.1 30.00 0.6931 0.5325 2.5425

1.7 1.76 0.6589 1.2820 0.3601

REC 0.6 5.00 0.6255 2.5415 2.0224

1.5 2.00 0.5596 0.0332 0.0106

1.6 1.88 0.5419 0.8495 0.2535

0.7 4.29 0.5363 -3.1185 -2.1271

1.4 2.14 0.5011 -0.3472 -0.1184

4. Discussion and Conclusion

CCCI presents the trend of steady ascension in the past decade, and the

psychological state of Chinese consumers has tended to be optimistic. At the

same time, we find that the variation trends of different sub-index have their

own characteristics, and their marginal impacts on CCCI also show time-

varying features. Results of this paper can present orientation of revised

measurement of CCCI in the future, that is we can consider assigning

different weights to different sub-indices for a more realistic comprehensive

index. In addition, we look forward to perfecting survey from dimensions and

survey time interval, also sample volume and its structure. At the same time,

we expect to introduce Bayesian thought and consider regional

heterogeneity to improve measurement of CCCI, so as to ensure that can be

more authentic, objective and representative.

Through cross-spectrum analysis results of CCCI and those major

economic indicators, it is further verified that all kinds of resonance periods

are not only common in these indicators with CCCI, but also closely

correlation between them in these resonance periods. However, on the other

hand, the fluctuations of various indicators are quite diverse in time-delays,

which is mainly determined by the transmission mechanism of periodic

variations between different economic activities. In addition to

demonstrating the leading and lagging relationship between CCCI and the

general economic situation, this study also incorporates different aspects of

export, domestic demand and investment into the analytical framework. It

further demonstrates the unique contributions of CCCI in three important

aspects of stimulating economic growth. In conclusion, while CCCI may not

have produced significant explanatory power on few macro-economic

indicators in specific resonance period, it is closely related to other major

134 | I S I W S C 2 0 1 9