Page 254 - Contributed Paper Session (CPS) - Volume 6

P. 254

CPS1909 Retius C. et al.

kurtosis clearly illustrates the non-normality (asymmetric property of the log

returns) of the distribution. Since the p-value for Ljung-Box statistic is less

than 0.05, we reject the null hypothesis of no presence of serial correlation.

The p-value for the ARCH Lagrange Multiple (ARCH LM) statistic is less than

0.05. Thus we reject the null hypothesis of absence of potential time varying

volatility (no arch effect) up to lag 20. These findings led to the adoption of an

asymmetric ARCH (APARCH) model as discussed in Section 2.

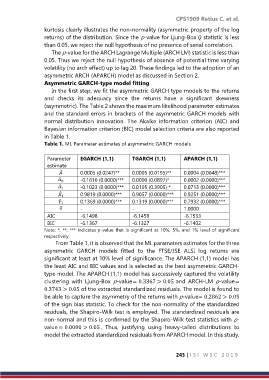

Asymmetric GARCH-type model fitting

In the first step, we fit the asymmetric GARCH type models to the returns

and checks its adequacy since the returns have a significant skewness

(asymmetric). The Table 2 shows the maximum likelihood parameter estimates

and the standard errors in brackets of the asymmetric GARCH models with

normal distribution innovation. The Akaike information criterion (AIC) and

Bayesian information criterion (BIC) model selection criteria are also reported

in Table 1.

Table 1. ML Parameter estimates of asymmetric GARCH models

Parameter EGARCH (1,1) TGARCH (1,1) APARCH (1,1)

estimate

̂ 0.0005 (0.0247)** 0.0005 (0.0195)** 0.0004 (0.0048)***

̂ -0.1616 (0.0000)*** 0.0000 (0.0897)* 0.0002 (0.0000)***

0

̂ -0.1023 (0.0000)*** 0.0105 (0.3905) * 0.0713 (0.0000)***

1

̂

0.9819 (0.0000)*** 0.9057 (0.0000)*** 0.9251 (0.0000)***

1

̂ 0.1369 (0.0000)*** 0.1319 (0.0000)*** 0.7932 (0.0000)***

1

- - 1.0000

AIC -6.1498 -6.1459 -6.1533

BIC -6.1367 -6.1327 -6.1402

Note: *, **, *** indicates -value that is significant at 10%, 5%, and 1% level of significant

respectively.

From Table 1, it is observed that the ML parameters estimates for the three

asymmetric GARCH models fitted to the FTSE/JSE ALSI log returns are

significant at least at 10% level of significance. The APARCH (1,1) model has

the least AIC and BIC values and is selected as the best asymmetric GARCH-

type model. The APARCH (1,1) model has successively captured the volatility

clustering with Ljung-Box p-value= 0.3367 > 0.05 and ARCH-LM p-value=

0.3743 > 0.05 of the extracted standardized residuals. The model is found to

be able to capture the asymmetry of the returns with p-value= 0.2862 > 0.05

of the sign bias statistic. To check for the non-normality of the standardized

residuals, the Shapiro-Wilk test is employed. The standardized residuals are

non-normal and this is confirmed by the Shapiro-Wilk test statistics with p-

value = 0.0000 > 0.05 . Thus, justifying using heavy-tailed distributions to

model the extracted standardized residuals from APARCH model. In this study,

243 | I S I W S C 2 0 1 9