Page 278 - Contributed Paper Session (CPS) - Volume 6

P. 278

CPS1929 Takayuki M.

where we regard qi,j,t as the short run correlation between assets i and j,

whereas ρi,j,t is a slowly moving long run correlation. Rewriting the first

equation of system as

conveys the idea of short run fluctuations around a time-varying long run

relationship. The idea captured by the DCC-MIDAS model is similar to that

underlying GARCH-MIDAS. In the GARCHMIDAS the short run component is

a GARCH component, based on daily returns, that moves around a long-run

component driven by realized volatilities computed over a monthly basis, see

Colacito et al. (2011).

3. Empirical Analysis

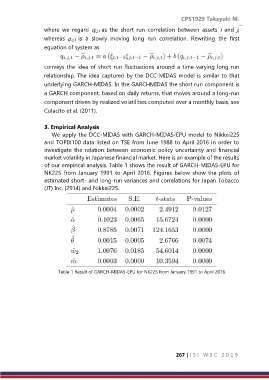

We apply the DCC-MIDAS with GARCH-MIDAS-EPU model to Nikkei225

and TOPIX100 data listed on TSE from June 1988 to April 2016 in order to

investigate the relation between economic policy uncertainty and financial

market volatility in Japanese financial market. Here is an example of the results

of our empirical analysis. Table 1 shows the result of GARCH-MIDAS-EPU for

NK225 from January 1991 to April 2016. Figures below show the plots of

estimated short- and long-run variances and correlations for Japan Tobacco

(JT) Inc. (2914) and Nikkei225.

Table 1 Result of GARCH-MIDAS-EPU for NK225 from January 1991 to April 2016

267 | I S I W S C 2 0 1 9