Page 280 - Contributed Paper Session (CPS) - Volume 6

P. 280

CPS1929 Takayuki M.

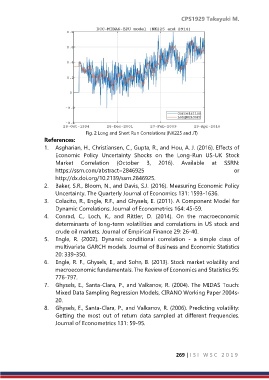

Fig. 2 Long and Short Run Correlations (NK225 and JT)

References:

1. Asgharian, H., Christiansen, C., Gupta, R., and Hou, A. J. (2016). Effects of

Economic Policy Uncertainty Shocks on the Long-Run US-UK Stock

Market Correlation (October 3, 2016). Available at SSRN:

https://ssrn.com/abstract=2846925 or

http://dx.doi.org/10.2139/ssrn.2846925.

2. Baker, S.R., Bloom, N., and Davis, S.J. (2016). Measuring Economic Policy

Uncertainty. The Quarterly Journal of Economics 131: 1593-1636.

3. Colacito, R., Engle, R.F., and Ghysels, E. (2011). A Component Model for

Dynamic Correlations. Journal of Econometrics 164: 45-59.

4. Conrad, C., Loch, K., and Rittler, D. (2014). On the macroeconomic

determinants of long-term volatilities and correlations in US stock and

crude oil markets. Journal of Empirical Finance 29: 26-40.

5. Engle, R. (2002). Dynamic conditional correlation - a simple class of

multivariate GARCH models. Journal of Business and Economic Statistics

20: 339-350.

6. Engle, R. F., Ghysels, E., and Sohn, B. (2013). Stock market volatility and

macroeconomic fundamentals. The Review of Economics and Statistics 95:

776-797.

7. Ghysels, E., Santa-Clara, P., and Valkanov, R. (2004). The MIDAS Touch:

Mixed Data Sampling Regression Models, CIRANO Working Paper 2004s-

20.

8. Ghysels, E., Santa-Clara, P., and Valkanov, R. (2006). Predicting volatility:

Getting the most out of return data sampled at different frequencies.

Journal of Econometrics 131: 59-95.

269 | I S I W S C 2 0 1 9