Page 246 - Invited Paper Session (IPS) - Volume 1

P. 246

IPS152 Paul F.

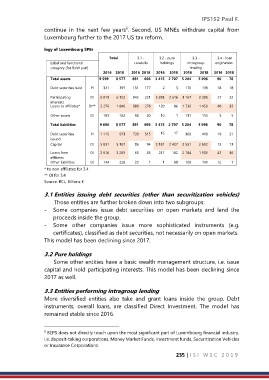

continue in the next few years . Second, US MNEs withdraw capital from

6

Luxembourg further to the 2017 US tax reform.

logy of Luxembourg SPEs

Total 3.1 - 3.2 - pure 3.3 - 3.4 - loan

Label and functional conduits holdings intragroup origination

category (for RoW part) lending

2016 2018 2016 2018 2016 2018 2016 2018 2016 2018

Total assets 9 599 8 577 891 696 3 415 2 707 5 204 5 096 90 78

Debt securities held PI 321 397 131 177 2 3 170 198 18 18

Participating DI 6 819 6 152 342 221 3 283 2 616 3 167 3 293 27 22

interests

Loans to affiliates* DI** 2 276 1 846 380 278 120 86 1 736 1 450 40 32

Other assets DI 183 182 38 20 10 1 131 155 5 5

Total liabilities 9 600 8 577 891 696 3 415 2 707 5 204 5 096 90 78

Debt securities PI 1 115 973 720 515 16 17 360 419 19 21

issued

Capital DI 5 831 5 167 86 94 3 181 2 427 2 551 2 632 12 13

Loans from DI 2 510 2 209 63 85 217 182 2 184 1 905 47 36

affiliates

Other liabilities OI 144 228 22 1 1 80 109 140 12 7

* to non affiliates for 3.4

** OI for 3.4

Source: BCL, Billions €

3.1 Entities issuing debt securities (other than securitization vehicles)

Those entities are further broken down into two subgroups:

- Some companies issue debt securities on open markets and lend the

proceeds inside the group.

- Some other companies issue more sophisticated instruments (e.g.

certificates), classified as debt securities, not necessarily on open markets.

This model has been declining since 2017.

3.2 Pure holdings

Some other entities have a basic wealth management structure, i.e. issue

capital and hold participating interests. This model has been declining since

2017 as well.

3.3 Entities performing intragroup lending

More diversified entities also take and grant loans inside the group. Debt

instruments, overall loans, are classified Direct Investment. The model has

remained stable since 2016.

BEPS does not directly touch upon the most significant part of Luxembourg financial industry,

6

i.e. deposit-taking corporations, Money Market Funds, Investment funds, Securitization Vehicles

or Insurance Corporations.

235 | I S I W S C 2 0 1 9