Page 248 - Invited Paper Session (IPS) - Volume 1

P. 248

IPS152 Paul F.

and holds approximately a similar amount of external assets (capital “in

transit”), thus generates balanced positions (i.i.p.), and transactions (b.o.p.-

7

financial accounts) . How to identify the networks, ie how to group together

Luxembourg affiliates of a single MNE?

The BCL’s main source for this task is internal: i.e. companies’ financial

statements and survey data. Yet Eurostat Enterprise Group Register (EGR) also

covers an increasing number of companies.

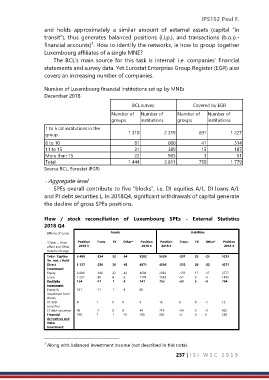

Number of Luxembourg financial institutions set up by MNEs

December 2018

BCL survey Covered by EGR

Number of Number of Number of Number of

groups institutions groups institutions

1 to 5 LU institutions in the

group 1 310 2 319 691 1 227

6 to 10 81 600 41 314

11 to 15 31 389 15 187

More than 15 22 503 3 51

Total 1 444 3 811 750 1 779

Source BCL, Eurostat (EGR)

- Aggregate level

SPEs overall contribute to five “blocks”, i.e. DI equities A/L, DI loans A/L

and PI debt securities L. In 2018Q4, significant withdrawals of capital generate

the decline of gross SPEs positions.

Flow / stock reconciliation of Luxembourg SPEs - External Statistics

2018 Q4

Billions of euros Assets Liabilities

*Other = Price Position Trans. FX Other* Position Position Trans. FX Other* Position

effect and Other 2018 3 2018 4 2018 3 2018 4

Volume Change

Total- Captive 5 488 -254 32 -64 5202 5524 -291 25 -25 5233

fin. Inst. / RoW

Direct 5 137 -250 30 -45 4871 4506 -233 20 -22 4271

investment

Equity 3 880 -166 22 -43 3694 2954 -176 17 -17 2777

Loans 1 257 -85 8 -2 1178 1553 -57 3 -5 1493

Portfolio 154 -11 1 -3 141 755 -53 5 -3 704

investment

Equity & 101 -11 1 -3 88

investment fund

shares

ST debt 8 1 0 0 9 13 0 0 -1 12

securities

LT debt securities 45 -1 0 0 44 714 -54 5 -3 662

Financial 198 7 1 -16 190 262 -4 0 0 258

derivatives and

Other

Investment

7 Along with balanced investment income (not described in this note).

237 | I S I W S C 2 0 1 9