Page 459 - Invited Paper Session (IPS) - Volume 1

P. 459

IPS177 Sayako K. M. et al.

estimated by combining the total outstanding at the nominal value based

on the FFA with microdata which includes individual characteristics of

debt securities. For instance, to calculate the debt securities by currency

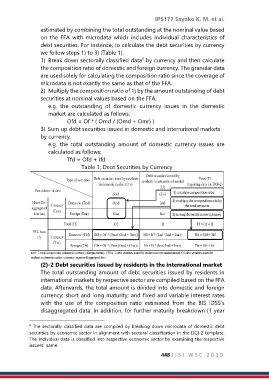

we follow steps 1) to 3) (Table 1).

6

1) Break down sectorally classified data by currency and then calculate

the composition ratio of domestic and foreign currency. The granular data

are used solely for calculating the composition ratio since the coverage of

microdata is not exactly the same as that of the FFA.

2) Multiply the composition ratio of 1) by the amount outstanding of debt

securities at nominal values based on the FFA.

e.g. the outstanding of domestic currency issues in the domestic

market are calculated as follows:

Ofd = Of * ( Omd / (Omd + Omr) )

3) Sum up debt securities issued in domestic and international markets

by currency.

e.g. the total outstanding amount of domestic currency issues are

calculated as follows:

Tfd = Ofd + Ifd

Table 1: Debt Securities by Currency

(2)-2 Debt securities issued by residents in the international market

The total outstanding amount of debt securities issued by residents in

international markets by respective sector are compiled based on the FFA

data. Afterwards, the total amount is divided into domestic and foreign

currency; short and long maturity; and fixed and variable interest rates

with the use of the composition ratio estimated from the BIS IDSS’s

disaggregated data. In addition, for further maturity breakdown (1 year

The sectorally classified data are compiled by breaking down microdata of domestic debt

6

securities by economic sector in alignment with sectoral classification in the DGI-2 template.

The individual data is classified into respective economic sector by examining the respective

issuers’ name.

448 | I S I W S C 2 0 1 9