Page 136 - Contributed Paper Session (CPS) - Volume 2

P. 136

CPS1461 Michal P. et. al

normalized test statistic allows us to omit the variance estimation and the

bootstrap technique overcomes the estimation of the correlation structure.

Hence, neither nuisance nor smoothing parameters are present in the whole

testing process, which makes it very simple for practical use. Moreover, the

whole stochastic theory behind requires relatively simple assumptions, which

are not too restrictive. The whole setup can be also modified by considering a

large panel size accounting also for situations with T tending to infinity.

Consequently, the whole theory would lead to convergences to functionals of

Gaussian processes with a covariance structure derived in a similar fashion as

for fixed and small T.

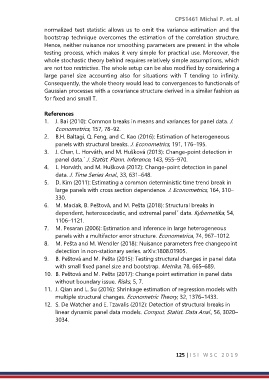

References

1. J. Bai (2010): Common breaks in means and variances for panel data. J.

Econometrics, 157, 78–92.

2. B.H. Baltagi, Q. Feng, and C. Kao (2016): Estimation of heterogeneous

panels with structural breaks. J. Econometrics, 191, 176–195.

3. J. Chan, L. Horváth, and M. Hus ̌ková (2013): Change-point detection in

panel data.´ J. Statist. Plann. Inference, 143, 955–970.

4. L. Horváth, and M. Hus ̌ková (2012): Change-point detection in panel

data. J. Time Series Anal., 33, 631–648.

5. D. Kim (2011): Estimating a common deterministic time trend break in

large panels with cross section dependence. J. Econometrics, 164, 310–

330.

6. M. Maciak, B. Pes ̌tová, and M. Pes ̌ta (2018): Structural breaks in

dependent, heteroscedastic, and extremal panelˇ data. Kybernetika, 54,

1106–1121.

7. M. Pesaran (2006): Estimation and inference in large heterogeneous

panels with a multifactor error structure. Econometrica, 74, 967–1012.

8. M. Pes ̌ta and M. Wendler (2018): Nuisance parameters free changepoint

detection in non-stationary series. arXiv:1808.01905.

9. B. Pes ̌tová and M. Pes ̌ta (2015): Testing structural changes in panel data

with small fixed panel size and bootstrap. Metrika, 78, 665–689.

10. B. Pes ̌tová and M. Pes ̌ta (2017): Change point estimation in panel data

without boundary issue. Risks, 5, 7.

11. J. Qian and L. Su (2016): Shrinkage estimation of regression models with

multiple structural changes. Econometric Theory, 32, 1376–1433.

12. S. De Watcher and E. Tzavalis (2012): Detection of structural breaks in

linear dynamic panel data models. Comput. Statist. Data Anal., 56, 3020–

3034.

125 | I S I W S C 2 0 1 9