Page 434 - Special Topic Session (STS) - Volume 3

P. 434

STS552 João Falcão Silva et al.

explored so far permits the validation of common data items across statistical

domains and provides additional information. The effectiveness of these

exercises depend on the availability of the information. We discuss

methodological aspects and offer guidance on derivation of household assets

abroad for individual countries. The Portuguese country-case would be

beneficial for other reporting countries (some countries have already started

adopting our approach that we shared).

Mirror data analysis ensures consistency and enhances statistical quality

standards, which is crucial for economists, analysts and policy makers who

explore this information. When these estimates are considered for both

BoP/IIP and RoW financial accounts purposes, there is also need to consider

impacts on the other flows (exchange rate, price and volume changes).

Furthermore, this approach can be seen as generic as it can be extended to

the other sectors (in fact applied the estimation to sectors F, P, C, G and H).

Hyperlink BIS

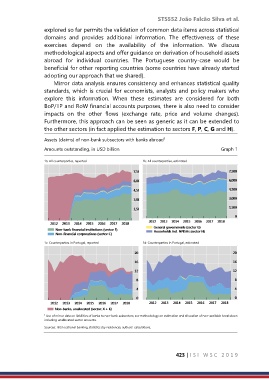

Assets (claims) of non-bank subsectors with banks abroad 1

Amounts outstanding, in USD billion Graph 1

1a: All counterparties, reported 1b: All counterparties, estimated

1c: Counterparties in Portugal, reported 1d: Counterparties in Portugal, estimated

1 Use of mirror data on liabilities of banks to non-bank subsectors; see methodology on estimation and allocation of non-available breakdown

including unallocated sector amounts.

Sources: BIS locational banking statistics (by residence); authors’ calculations.

423 | I S I W S C 2 0 1 9